FinancialForce recently introduced FinancialForce ERP, a family of cloud-based software designed to support a variety of customer-centric businesses such as professional services organizations or companies that specialize in business and industrial distribution. Many of these types of businesses are midsize or small (having 50 to 1,000 employees) and can benefit from the integration of FinancialForce’s accounting, professional services automation, human capital management (HCM) and supply chain management (SCM) software. The company added the last two capabilities at the end of 2013 with the acquisitions of Vana Workforce and Less Software, respectively, which I commented on. Like FinancialForce’s, their software runs on the Salesforce1 platform, which means that integration of these elements was straightforward. It also enables companies that use or are planning to use salesforce.com for sales and customer service to simplify integration of those with the operational and back-office software, by enabling single sign-on, end-to-end process management and a single data source for reporting and analysis. This integration can significantly reduce or even eliminate the need to re-enter information into systems or to use spreadsheets, documents and email to manage processes. With all of the data available in a single system, creating reports and automating their distribution becomes easier. All of this, in turn, should cut the amount of time and effort spent on administrative and clerical functions and enhance the productivity of the organization.

(having 50 to 1,000 employees) and can benefit from the integration of FinancialForce’s accounting, professional services automation, human capital management (HCM) and supply chain management (SCM) software. The company added the last two capabilities at the end of 2013 with the acquisitions of Vana Workforce and Less Software, respectively, which I commented on. Like FinancialForce’s, their software runs on the Salesforce1 platform, which means that integration of these elements was straightforward. It also enables companies that use or are planning to use salesforce.com for sales and customer service to simplify integration of those with the operational and back-office software, by enabling single sign-on, end-to-end process management and a single data source for reporting and analysis. This integration can significantly reduce or even eliminate the need to re-enter information into systems or to use spreadsheets, documents and email to manage processes. With all of the data available in a single system, creating reports and automating their distribution becomes easier. All of this, in turn, should cut the amount of time and effort spent on administrative and clerical functions and enhance the productivity of the organization.

From its inception, FinancialForce has had a two-pronged market strategy. Like all ERP vendors, it offers a suite of back-office functionality, but it also offers the option of buying separate component applications that address specific needs. Because all of the code within its suite is running on a single platform in the cloud, FinancialForce can offer an interoperable set of capabilities that can be purchased as a single application or in components. In the latter case, its sales order processing module can be used to bridge the salesforce.com cloud-based sales process to the user company’s on-premises ERP system. This enables companies to replace desktop spreadsheets or paper forms to pass order information from one system to the next – a time-consuming and error-prone process. The unified approach also makes it possible for buyers to acquire a full suite in stages, which may be more appropriate for their needs and budgets. FinancialForce’s recent acquisitions and their integration into the single offering takes the strategy a step further. Companies can buy additional component pieces (HCM and supply chain) that operate on the Salesforce1 platform. Moreover, FinancialForce now has a more comprehensive suite for two types of businesses, professional services organizations (PSOs) and distribution companies.

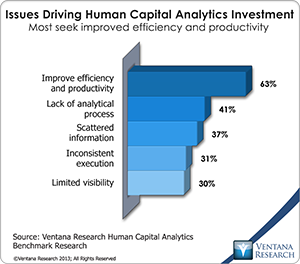

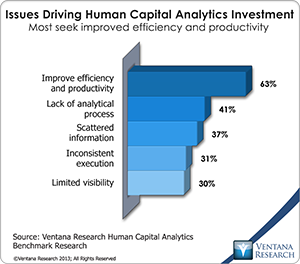

The recent release of FinancialForce ERP was designed to put additional emphasis on the suite offering. As an ERP suite, FinancialForce is suited for a variety of businesses, but two in particular are worth highlighting. One is PSOs (consultancies and the like) as well as stand-alone professional services organizations within a large corporation that need systems to manage their operations effectively yet interoperate with the parent company’s core ERP system. The integration of the accounting and human resources capabilities with professional services automation (PSA) software provides a way of simplifying the management of day-to-day operations while substantially reducing the administrative burden for record-keeping, accounting and compliance. These sorts of businesses are well-served by an integrated suite of capabilities that automate and manage the sales, staffing and project management elements of their operations, while increasing the efficiency, timeliness and accuracy with which they perform critical tasks such as customer billing. Once a professional services company expands past a handful of billing individuals, the administrative burden on the senior members of the firm can be anything from a nagging distraction that saps their productivity to a time-sink that diminishes revenues. The right software enables them to scale their business without having to make corresponding investments in administrative personnel. Human capital management is especially important for PSOs since people are the core of their business model. Applications like Vana Workforce have the potential to improve the effectiveness with which a PSO handles its members. For small to midsize consultancies, however, the use of human capital analytics is especially important for improving efficiency and productivity, as our research has shown.

The other type is business and industrial distribution companies.  These tend to be sales-oriented and, as such, might already be salesforce.com customers. In addition to the financial management functions, FinancialForce ERP provides necessary capabilities that support some of the supply chain management aspects of their sales processes, including configure, price and quote (CPQ) to maximize revenues as well as efficient and accurate order fulfillment, and contract, inventory and supplier management. Note, however, that although FinancialForce calls this part of its offering SCM, the software does not have the full set of supply chain functionality offered by established vendors in this field.

These tend to be sales-oriented and, as such, might already be salesforce.com customers. In addition to the financial management functions, FinancialForce ERP provides necessary capabilities that support some of the supply chain management aspects of their sales processes, including configure, price and quote (CPQ) to maximize revenues as well as efficient and accurate order fulfillment, and contract, inventory and supplier management. Note, however, that although FinancialForce calls this part of its offering SCM, the software does not have the full set of supply chain functionality offered by established vendors in this field.

Since FinancialForce ERP is a cloud-based application, it’s suited to the needs of companies that have outgrown small business accounting software packages and can benefit from having the ability to connect sales, marketing and customer service capabilities with their back-office functions. Many companies with 50 to 500 employees still use basic financial software packages because they hesitate to make the investment in an on-premises accounting package and the IT staff they would need to support it. But they are foregoing the operational and management benefits they could have by using more capable software that doesn’t require a large up-front commitment and ongoing reliance on staff to support an IT system. The Salesforce1 platform also incorporates Chatter, messaging software that facilitates collaboration in context among employees.

Companies with 50 to 1,000 employees, especially those in professional services and distribution, that have a fragmented collection of software for sales, accounting, order and inventory management, and HCM, should consider FinancialForce to address their needs. This is especially true for midsize companies that have outgrown their entry-level accounting packages and are held back by their limited analysis and reporting capabilities.

Regards,

Robert Kugel – SVP Research

(having 50 to 1,000 employees) and can benefit from the integration of FinancialForce’s accounting, professional services automation, human capital management (HCM) and supply chain management (SCM) software. The company added the last two capabilities at the end of 2013 with the acquisitions of Vana Workforce and Less Software, respectively,

(having 50 to 1,000 employees) and can benefit from the integration of FinancialForce’s accounting, professional services automation, human capital management (HCM) and supply chain management (SCM) software. The company added the last two capabilities at the end of 2013 with the acquisitions of Vana Workforce and Less Software, respectively,