Zuora RevPro Addresses Revenue Recognition Compliance

Earlier this year Zuora acquired revenue recognition software vendor Leeyo. Zuora, which initially focused on taming the complexities of subscription billing, has been broadening its software offerings to handle a wider set of the operational and financial requirements of a subscription business. Leeyo held a Revenue Recognition Summit in 2016 and the event was recently repeated. The need for the Summit reflects the impact new standards for accounting for contracts will have on subscription businesses. Compliance with these standards is proving to be a major challenge for companies that have subscription or recurring-revenue business models.

The new revenue recognition standards for companies that do business using contracts are ASC 606 for companies in the United States and IFRS 15 for companies in most of the rest of the world. The standards are set to go into effect for public companies in 2018 and private ones in 2019. The accounting standards bodies (the Financial Accounting Standards Board or FASB in the U.S. and the International Accounting Standards Board or IASB elsewhere) intended the new approach to revenue recognition to involve the least amount of disruption possible. However, it appears that they badly underestimated the difficulty of putting their new conceptual framework for revenue recognition into practice for companies that use subscription or project business models.

The Summit highlighted the fact that companies that offer even moderately complicated subscriptions face challenges in accounting for these revenues and for the incremental costs of obtaining these contracts (such as sales commissions). The presentations and conversations with participants underscored the seriousness of these challenges.

Managing all the details related to a contract, the changes that can take place over the life of the contract and the treatment of a contract renewal is an exercise of hair-curling complexity. Handling the bookkeeping and accounting as well as the financial, IT and operational controls associated with the accounting process adds another level of effort. Software designed for companies with complex subscription business models can substantially reduce the effort required for compliance.

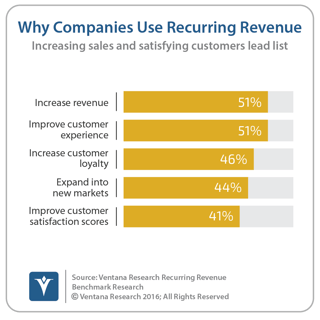

The subscription economy has been expanding rapidly, especially in the technology sector.  One reason is that customers increasingly are electing to acquire software as a subscription service rather than purchasing a perpetual license. Our benchmark research found that companies use a subscription or recurring-revenue business model for multiple reasons, but half (51%) do it to increase revenue and to improve customer service.

One reason is that customers increasingly are electing to acquire software as a subscription service rather than purchasing a perpetual license. Our benchmark research found that companies use a subscription or recurring-revenue business model for multiple reasons, but half (51%) do it to increase revenue and to improve customer service.

The expansion of the subscription economy is likely to continue. For instance, the Internet of Things will enable many traditional product companies to supplement and enrich their offerings with useful services sold on a subscription basis.

Subscription billing emerged as a specific software category because ERP systems at that time were not designed to handle anything other than simple subscriptions such as one for a magazine. In that case, a monthly magazine publisher pockets the cash for a one-year subscription up front but recognizes only one-twelfth of that amount as revenue when the issue is mailed to the subscriber.

However, more complicated subscription arrangements are increasingly common. A company’s offering can include multiple elements such as one-time up-front services (for instance, installation and training) and ongoing service or delivery of goods and on-demand goods or services, all extending over a period of several years. Often, these subscriptions are modified during the term of the contract by adding services or increasing or decreasing the number of users. Some services vendors have deal structures that are seasonal, or that add promotions toward the end of the subscription to encourage a renewal or are usage based. There may be volume-based discounts (termed “variable consideration” by accountants) that may be applied in different ways (such as prospectively or retrospectively). Each of these variations adds to the complexity of invoicing customers and accounting for revenue and related expenses. And accounting for them will be that much more difficult with the new standards.

Even bricks-and-mortar retailers can face revenue recognition issues. For example, Starbucks must account for the cash it receives from customers on their Starbucks Cards under the  new revenue recognition rules. The accounting is complicated because the “contract” is open-ended (there’s no time limit to spend the balances) and because there are “variable considerations” involved in the form of discounts and rewards offered to Card holders.

new revenue recognition rules. The accounting is complicated because the “contract” is open-ended (there’s no time limit to spend the balances) and because there are “variable considerations” involved in the form of discounts and rewards offered to Card holders.

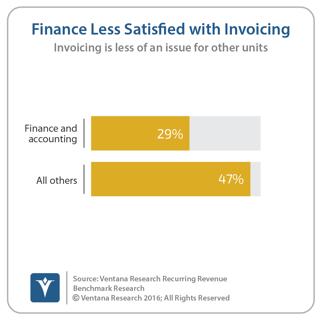

It’s easy for those outside of the finance department to overlook the impact that more complex subscription arrangements can have on the department. For example, in our research only 29 percent of participants with finance and accounting titles said they are satisfied with their company’s invoicing system, compared to nearly half (47%) of those who work in other parts of their company.

Companies can substantially reduce the difficulty by using a dedicated application designed to support the billing and accounting process in a subscription revenue business. They must also be mindful of the impact of “upstream” processes such as the effect of data that is (and isn’t) recorded in a CRM or contract management system on the accounting department for billing as well as revenue recognition.

Subscription companies face two sets of issues related to compliance with the new accounting standards. One is in migrating from their current standard to their new one. The other is recasting their processes and IT systems to minimize the amount of work required to support ongoing accounting and reporting under the new standard.

As to the first issue, the transition process is complicated by the requirement that a company must present its financial statements using the applicable new and previous standards for the periods in which they are reporting. If you’re not an accountant this may sound straightforward but as you dig into the specifics of what needs to be done, the contortions and calculations required to deal with the minutiae are anything but.

For instance, by now many accountants are aware that in addition to managing revenue recognition from a contractual relationship, they also must account separately for the incremental costs of obtaining that contract, notably sales commissions. If the contract extends for more than one year (typical for business software licenses) these costs must be capitalized and then amortized over the life of the contract. However, few accountants I spoke with are aware that the employment taxes associated with those commission payments must also be included in the calculations, and these include their own complications.

The above example illustrates a common issue facing almost all subscription revenue companies: The data required is held in multiple systems and must be brought together to accurately account for both revenue and expenses. In the example above, it may mean having to access the payroll data to tie the commission expense to the relevant taxes paid. Sessions at the Summit underscored that the process of bringing all the historical data together is very time-consuming.

Moreover, in the transition to the new standard, companies will need to recast their prior periods’ accounting as if it had been performed under the new standard. However, this data may never have been recorded (because the information wasn’t relevant to the operational or accounting needs when the system was set up under a different set of accounting standards) or there are data quality issues (such as frequent errors or inconsistencies in the data that was recorded). Public companies that haven’t substantially completed their migration to the new standards, especially those in the U.S., will be in spreadsheet hell for the next 18 months as they cobble together their financial reports using what’s referred to as the “modified retrospective” presentation method.

To make the ongoing process of accounting for subscriptions sustainably efficient, most corporations will need to rethink their systems architecture to enable a form of “straight-through processing.” By that I mean ensuring that the data associated with the creation or modification of contracts and related transactions is automatically passed along each step of the contract life cycle, from the creation of a sales opportunity to the collection of cash. To achieve this, data must be entered once, no data should be handled in desktop spreadsheets and there must be a single authoritative set of data.

As to this last point, the data required for compliance will almost certainly be created in multiple systems, including CRM, ERP and sales compensation management. It’s also likely that some data will be kept in multiple systems (for instance, payroll taxes held in an HR system will be copied to the sales compensation management system). That data may be duplicated in multiple systems but the company’s IT architecture must be structured so that there is only one system of record for a specific set of data.

Along with systems, corporations must examine their processes to ensure that they are accurately and consistently collecting all necessary information about transactions. They must provide training and communicate the importance of these changes. Above all, they must have an approach that balances the needs of the sales and accounting functions.

Most of all, though, corporations will need to use the right technology to support ongoing compliance with the new revenue recognition standards. I recommend that companies with subscription business models evaluate Zuora’s portfolio of offerings, especially RevPro for revenue recognition. Optimally, this assessment with be part of an overall review of the systems that they use to manage their subscriptions from opportunity to collection.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter

and connect with me on LinkedIn.

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for ISG Software Research. His team covers technology and applications spanning front- and back-office enterprise functions, and he runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).