I was invited to sit on a panel at CFO 3.0 events held in San Francisco and New York hosted by Sage Intacct. This event is about the evolution of the role that started with the archetypal CFO 1.0, the green-eye-shade-wearing bean counter. Lacking usable technology, he or she was limited to keeping the books in good order and simply reporting what just happened. Today’s CFO 2.0 relies on technology developed over the past two decades as well as the broader perception of the role, catalyzed by technology that provides deeper analysis to explain what happened and why. At the next 3.0 level, CFOs will lead an organization that can provide guidance to executives and managers so they can better shape the company’s future, providing insights through rich scenario planning.

Speakers at the event presented the findings of a study undertaken by Sage Intacct on the impact of digital transformation on the finance department. The panelists included CFOs of midsize companies whose organizations demonstrate two traits of highly effective finance and accounting departments: a deep level of engagement with all facets of their company and a pervasive use of technology to support operations. One of the panelists was Tania Zieja, the CFO of Halloran Consulting Group, which received our Digital Leadership Award in the Office of Finance in 2019.

To put the concept of the CFO 3.0 in perspective, the vision of transforming the finance department into a strategic player has been around for decades; today’s technology finally offers the possibility of a greater transformation over the coming decade in how the office of finance operates than has occurred over the past 50 years. Technologies including artificial intelligence, in-memory computing and more advanced databases are enabling a radical redefinition of how work is done and what work will be done in the department. Applying these technologies will bring us closer to that aspirational condition where computers adapt to the individual performing work rather than requiring that the individual adapt to the shortcomings of computers. In turn, this will improve the efficiency of the department. The CFO 3.0 uses the time saved to transform into a finance department that’s more of a strategic advisor to the rest of the company.

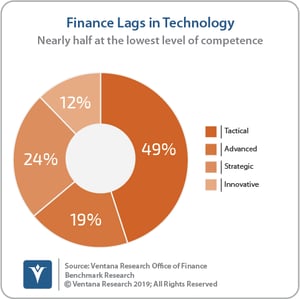

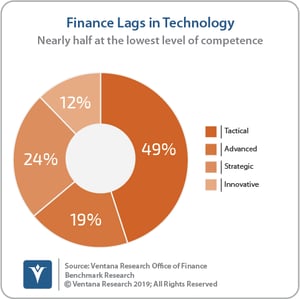

Butting up against this utopian future is the reality that today’s office of finance is a technology laggard. We use our benchmark research methodology to assess how organizations perform core business processes and functions. To do this we evaluate performance on the dimensions of people, process, information (data) and  technology (chiefly software), distilling our evaluation into four levels of performance: from top to bottom, Innovative, Strategic, Advanced and Tactical. Our recent Change in the Office of Finance benchmark research revealed that half (49%) of companies are at the lowest level of performance in using technology while just 12 percent are at the highest.

technology (chiefly software), distilling our evaluation into four levels of performance: from top to bottom, Innovative, Strategic, Advanced and Tactical. Our recent Change in the Office of Finance benchmark research revealed that half (49%) of companies are at the lowest level of performance in using technology while just 12 percent are at the highest.

Our research finds a strong correlation between competence in using technology and how well a finance and accounting organization performs. For example, a large majority (88%) of the companies at the Innovative level perform accounting very well compared to 44 percent of those at the Tactical level that perform accounting very well. Similarly, 69 percent of Innovative companies perform budgeting and fiscal control very well versus just 18 percent of those that are Tactical. Nearly two-thirds (64%) of Innovative companies do cost accounting very well, while only 28 percent of Tactical organizations achieve that level of performance.

Analytics work better too: 64 percent of Innovative companies perform analytics very well compared to 28 percent of those that are at the Tactical level. And Innovative companies are better at reporting: 63 percent of them provide timely  information to the rest of the company, while only 36 percent of Tactical companies do so.

information to the rest of the company, while only 36 percent of Tactical companies do so.

The CFOs that participated on the panels reported using technology to gain efficiency by significantly reducing manual tasks. Cutting down or even eliminating paper in processes (for example, in expense reimbursement or the use of electronic timecards) frees up staff time to do more productive tasks.

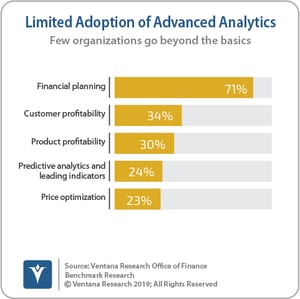

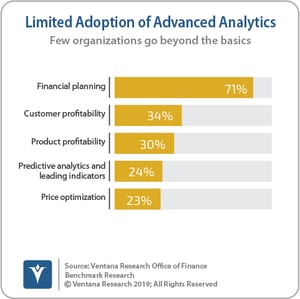

What to do with the time saved? One area that needs attention is profitability management. Our research reveals that only 34 percent of finance departments measure customer profitability and 30 percent measure product profitability. Using technology to improve departmental efficiency often means that rapidly growing companies are able to scale without having to add administrative headcount.

The benefits of finance transformation extend more widely. For instance, in addition to improving department efficiency, electronic timecards and expense reporting reduce administrative workloads for employees and generally improve the timeliness and accuracy of time sheets and expense reports. For professional services businesses, being able to bill sooner accelerates cashflow; more timely and accurate billing also has a positive impact on customer relationships.

The CFO of the Center for Employment Opportunities, Panagiota Mehendru, shared another example of benefits beyond the finance department, describing how her nonprofit works with individuals just coming home from prison to provide ongoing employment support and financial stability. Having implemented electronic systems, the organization was able to eliminate preparing hundreds of paper payroll checks for its clients. Eliminating the hundreds of checks they were cutting every day saved considerable time and improved the efficiency of the department. However, the change also had a significant positive impact on the organization’s clients, who often do not have bank accounts. Having a payment card advances the mission of this nonprofit because its clients have immediate access to their money and don’t have to pay a check cashing fee.

Technology is essential but by itself is insufficient for transforming the finance and accounting organization. There are two people-related challenges that CFOs must address. The CFOs on our panels discussed the importance of meeting the first challenge: actively engaging with the rest of the company. The vision of the CFO being a trusted advisor to the CEO and the rest of the company isn’t achievable unless the CFO is fully engaged with the entire company. For instance, Shari Freedman, the CFO of Room to Read, a nongovernmental organization enabling childhood literacy, spends a considerable percentage of her time at its locations around the world to develop and instill best practices.

The second challenge is having the right technology skills in the department. Unfortunately, those skilled in accounting and financial analysis aren’t necessarily technology experts. And without a fundamental understanding of how the tools in use work, it can be difficult for a department to make good technology purchasing decisions or design technology-driven processes that enhance effectiveness. It may not even be able to use the technology assets it owns. Our Change in the Office of Finance research reveals the importance of having a finance IT function.

People have predicted the transformation of the finance organization for decades, and yet so far transformation has failed to arrive in any meaningful way. Having been skeptical in the past, I now believe that change is finally underway. However, this transformation is not going to happen overnight. Although nine out of 10 executives say they want their finance organization to be a strategic partner to their company, we predict that by 2023 fewer than 25 percent of finance organizations will evolve into this role. Still, this will be a major improvement as I estimate that number today is 10 to 15 percent.

Technology is only now able to play a key role in fundamentally changing how the department performs its work. Technology makes continuous accounting and continuous planning possible. Though technology is the catalyst, the evolution to a new generation of CFO depends on the individual, an individual who’s not just technically competent but one who is also outgoing and engaged with the business.

Regards,

Robert Kugel

technology (chiefly software), distilling our evaluation into four levels of performance: from top to bottom, Innovative, Strategic, Advanced and Tactical. Our recent Change in the Office of Finance benchmark research revealed that half (49%) of companies are at the lowest level of performance in using technology while just 12 percent are at the highest.

technology (chiefly software), distilling our evaluation into four levels of performance: from top to bottom, Innovative, Strategic, Advanced and Tactical. Our recent Change in the Office of Finance benchmark research revealed that half (49%) of companies are at the lowest level of performance in using technology while just 12 percent are at the highest. information to the rest of the company, while only 36 percent of Tactical companies do so.

information to the rest of the company, while only 36 percent of Tactical companies do so.