A couple of years ago, I started talking about a “New Era of Trade.” Its starting point was the world financial crisis in 2007, but the evidence that we were experiencing a shift only became obvious years later. I think “new era” is a better description of what’s going on than calling these bilateral ructions a “trade war.” I avoid that latter term because I believe it should apply to an environment that truly merits such a description, one similar to the period from the late 1920s and well into the 1930s when escalating tariffs, export taxes and competitive currency devaluations caused world trade volume to plummet by two-thirds. Until 2020, world trade growth had only been slowing, not declining.

For decades, sourcing and supply chain management was focused almost exclusively on achieving the lowest cost. In the new era of trade, the execution of these systems has become more complex as companies shift their focus to emphasize business continuity and sustainability. Supply chains must now be adaptive and resilient, accommodating change with the least disruption and at the lowest cost. Sourcing decisions, logistics and product design must be crafted with an eye to a far-from-perfect and changeable world. Companies must balance cost against resiliency and sustainability, and when necessary, achieve continuity by having the ability to make changes rapidly with assurance and limited risk.

The new era of trade requires more complex decision-making than in the recent past. There are at least two major factors at work. First, calculating and forecasting the landed cost of a shipment is more complicated. Not only are there more moving parts but what was the lowest landed cost last week might not be the lowest cost this week, let alone next month. Two potential factors contributing to landed cost variation are the ongoing fragmentation of tariff regimes and the cost of fuel. Duties paid on a shipment traveling from point A to point B might be higher than the same shipment traveling from point A to point C, and then to point B. The cost might also fluctuate significantly when fuel prices spike, altering the transportation costs. Second, risk is a more important consideration than it was in the old era of trade, one that must be actively managed. Risk in sourcing and supply chain management comes in many forms, but two stand out: supply risk and reputational risk. There are multiple forms of supply risk. For example, does the vendor have the ability to deliver to specification on time and at cost? That is threatened if the supplier does not have enough excess capacity, faces labor issues, suffers natural disasters or has insufficient capitalization, to name a few. Reputation risk arises when customers or society in general find the business practices of a contractor or subcontractor unacceptable. For example, the use of child labor, or when the source of the product or service is a pariah state.

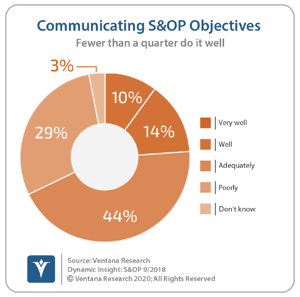

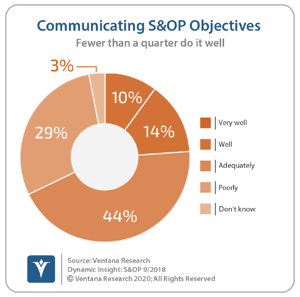

The shift in trade behaviors has  increased the importance of communications between the strategy and compliance elements of an organization such as finance and legal, and frontline operations such as sourcing and supply chain. Because of the steady focus on lowering costs above all else, communication was not as consequential as it is today. Successfully balancing the trade-off between cost and sustainability in a more dynamic environment requires an ongoing conversation between all parties, clearly laying out priorities and constraints. However, our most recent S&OP Dynamic Insights research found that only 24% of companies communicate their supply chain objectives well or very well, while almost one-third communicate poorly.

increased the importance of communications between the strategy and compliance elements of an organization such as finance and legal, and frontline operations such as sourcing and supply chain. Because of the steady focus on lowering costs above all else, communication was not as consequential as it is today. Successfully balancing the trade-off between cost and sustainability in a more dynamic environment requires an ongoing conversation between all parties, clearly laying out priorities and constraints. However, our most recent S&OP Dynamic Insights research found that only 24% of companies communicate their supply chain objectives well or very well, while almost one-third communicate poorly.

In the absence of action by the finance and legal teams, I suggest that sourcing and supply chain executives take the lead in establishing regularly scheduled meetings with an agreed-upon strategy for discussing priorities, setting objectives and evaluating results. Identifying risk is essential but insufficient. There must be an ongoing dialogue between the senior leadership and sourcing and supply chain executives to agree on the desired trade-offs between revenues, cost and risk. To ensure clarity and consistency of this process, it is necessary to have a decision-making framework for these assessments to determine the optimal trade-off as well as subsequent purchasing decisions. While these discussions should avoid getting into the weeds, those in sourcing and supply chain should provide real examples so that those in executive and staff roles have a better understanding of the dynamics of transaction-level decision-making.

There are elements of contracting that one might think should be directed by legal or finance but are not, so it is important for sourcing and supply chain professionals to take the lead as well as be another set of eyes. For example, if your organization is one of the largest clients for a particular supplier, does the master contract with that supplier provide “most favored customer” treatment when items are in short supply? Rather than assuming that a sufficient volume of business or a great working relationship and verbal assurances exist, get it in writing ahead of time to achieve maximum leverage and reduce potential risk of supply disruption. Payment terms should also be in every contract. All contracts should have a consistent pay-by date. Where appropriate, there also should be discounts for early payment. Because it is easily assumed that contracts are a legal and finance matter, the ball is too frequently dropped.

The new era of trade calls for a more explicit and organized approach to managing priorities in an increasingly complex trading environment. If there isn’t senior-level focus on managing objectives, trade-offs and risks, I recommend that sourcing and supply chain executives take the lead, quantifying the opportunities versus the costs of doing nothing.

Regards

Robert Kugel

increased the importance of communications between

increased the importance of communications between