We’re in a new era of trade, the result of converging issues that have been building for at least a decade. Structurally and politically, the liberal ethos that drove the trade environment through the second half of the 20th century and into the 21st has changed. There will be a new equilibrium in the future; getting there, though, will be a bumpy ride. Adding to the challenges posed by a shifting trade environment are commodity and currency market volatility and the impacts of ongoing legal, regulatory and taxation changes.

Tariffs and trade regulations have become more like forces of nature; they are far less predictable and more consequential than in the past. Currencies also have been extremely volatile; short of a formal devaluation, this degree of volatility was unthinkable in developed economies the second half of the 20th century. To achieve business objectives, organizations must be able to respond to these changes quickly and with intelligence that leads to better business performance.

At the same time, for all the talk of trade wars, I seriously doubt we’re looking at a real trade war environment of the magnitude that existed in the 1930s. (Charles Kindleberger’s The World in Depression 1929-1939 lays out the magnitude and impact of those trade wars.) But it’s also a situation that’s more serious than the trade skirmishes that have erupted periodically over the past few decades. Consequently, sourcing, logistics and supply and demand chains have become more strategic matters. Companies that can make these operational functions more adaptable as the environment changes will have an advantage in achieving greater profitability and higher market share.

The current escalation of trade friction is made all the more challenging because of shifts in the business environment. For example, there are technology-driven changes in retail and wholesale trade practices (“I want a more Amazon-like experience.”), a market-driven explosion of stock keeping units (SKUs), growing use of contract manufacturers and a proliferation of commerce channels. In this environment, it’s that much harder for organizations to make good sourcing, purchasing, supply chain management and production decisions at a pace that enables them to maintain market share and achieve profitability and performance targets. Keeping multiple options open is essential. But to make the best choices among multiple options, companies will need to be able to compare, for example, total landed costs under different scenarios on an ongoing basis. These costs include all fees, taxes and charges in sourcing from point A and delivering it to point Z, usually with multiple stops along the way.

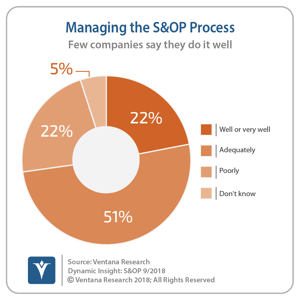

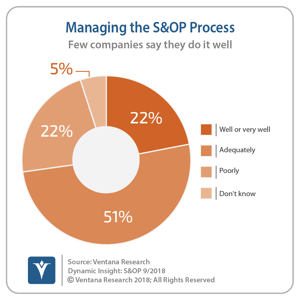

Few companies are up to this challenge of establishing and maintaining agility in managing their supply and demand chains. Our supply chain research has found that they aren’t, for  example, managing their S&OP processes well. Just 22 percent said they do it well or very well – the same proportion that do it poorly – and half said they do only an adequate job.

example, managing their S&OP processes well. Just 22 percent said they do it well or very well – the same proportion that do it poorly – and half said they do only an adequate job.

The research finds several factors at work here. Companies find it difficult to acquire and handle the data necessary to manage even moderately complex supply chains. They rely on spreadsheets for modeling and analysis. Because of that, supply chain managers struggle to achieve the agility they need to cope with a more dynamic environment. And they often don’t have enough support from executives unless they work in a corporation that views supply chain management and sales and operations planning as strategic to their success. In this new era of trade, adequate isn’t adequate anymore. Companies can’t gain a competitive advantage with so-so supply chain management.

In the new era of trade, sourcing, supply chain planning and execution are more complex. Supply chains must be adaptive and resilient, which means that they must be able to accommodate change with the least disruption and at the lowest cost. Sourcing decisions, logistics and product design must be designed with an eye to a far-from-perfect world.

To deal with the new era of trade, companies need systems that give them two essential ingredients – intelligence and visibility. Intelligence is the result of having timely and accurate data and a system that facilitates analysis, modeling and forecasting. Visibility into states and processes promotes situational awareness, allowing organizations to know sooner and, presumably, act more quickly to address issues and grab opportunities.

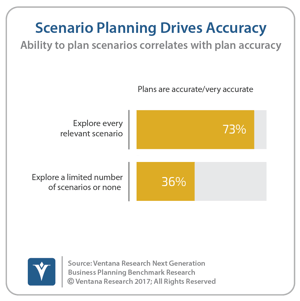

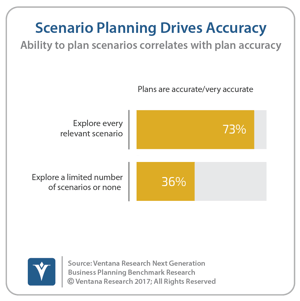

One of the cruel realities of enterprise planning is that any time spent on the mechanics of planning is time unavailable for analyzing the impact of the plan under different scenarios and multiple time horizons. In other words, the time spent on constructing or modifying models, collecting and cleaning data, massaging results and rolling up spreadsheets is time that isn’t available for planning. If too much time is spent on the mechanical tasks of creating a single plan, organizations aren’t likely to want to multiply that time by evaluating multiple scenarios. As a result, more than half (54%) of the companies participating in our Next-Generation Business Planning benchmark research said they have a limited or even no ability to understand these decision-making trade-offs. And fewer than one-quarter – just 24 percent of organizations – said they have a clear understanding of their supply chain plans’  implications. Understanding trade-offs and consequences improves plan accuracy: Nearly three-fourths (73%) of companies that can explore every relevant scenario said they have accurate plans compared to just 36 percent that have a limited or no ability to do this.

implications. Understanding trade-offs and consequences improves plan accuracy: Nearly three-fourths (73%) of companies that can explore every relevant scenario said they have accurate plans compared to just 36 percent that have a limited or no ability to do this.

In addition, managers also must be able to revise targets quickly when market realities dictate a change. And they need to be able to understand the downstream consequences of those changes. Again, time here is of the essence. If it takes hours or days to work through the implications of a change, when time is tight, decision-makers will have to go with their gut. That’s not as good as checking the change to see its future impact on key customers, costs or anything else. To be able to plan intelligently, managers require software that enables the organization to rapidly revise supply chain plans to meet targets within the current set of constraints.

The financial dimension is an essential but often overlooked aspect of supply chain planning and S&OP, a hangover from the days when technology wasn’t capable of dealing with the physical goods and the financial elements at the same time. In our Business Planning research, just one-third of organizations said that they can measure supply chain profitability well or very well. In today’s new era of trade, incorporating accurate costs into a supply chain plan results in more strategic planning. Companies need to understand the costs associated with any action plan as well as its impact on fulfillment and key customers in order to make knowledgeable trade-offs.

In the past technology limited consideration of the financial dimension, but today the right tools make it possible to take account of costs and execute rapid planning cycles.

That’s important because three cost drivers are likely to vary enough in a company’s planning scenarios to be a material consideration. The first is currency instability, as national economic and monetary fluctuations affect exchange rates. Whereas in the past rates typically didn’t change more than a 10th of a percent in a day, today a move of one percent or more a day is common. The U.S. dollar-Euro exchange rate moved recently by 19 percent over the course of a year.

The second driver is a volatile trade environment. National and bilateral decisions related to tariffs, taxation and trade-related legislation can have major impacts on supply chain management models, so organizations must regularly reconsider these factors. Both in the long and short run, optimizing “from-to” choices – where an item is sourced and where it is sent – based on actual costs is much more complex in a fragmented legal and fiscal world trade environment.

A third driver is rising labor costs. Working population growth is slowing or declining in most developed economies, escalating wage and benefit pressures in what were once relatively inexpensive labor pools. This means that in the long term, labor costs also are likely to be a more significant sourcing consideration. If labor costs come up in discussions about future sourcing, wouldn’t it be great if you could rapidly and confidently graph total landed costs across exchange rates, or where labor costs in local currency will require reexamining sourcing decisions?

Software by itself will not solve a complex business issue like managing supply chains, sales and operations planning or sourcing. Nonetheless, solving these complex issues takes more than spreadsheets. Our research confirms that despite their ubiquity, spreadsheets are an inadequate tool for these business processes. While 77 percent of companies reported using spreadsheets either exclusively or in conjunction with an enterprise system such as ERP to manage their supply chains, there is overwhelming evidence that they are error-prone and time-consuming and do not scale. Almost two-thirds (64%) of participants agreed that using spreadsheets makes supply chain planning and S&OP difficult. And only 12 percent of companies said spreadsheets enable them to develop contingency plans, which as essential for agility.

In the new era of trade, senior executives, particularly the CEO and CFO, must investigate whether their company has the tools, processes, data and training that will enable their company to thrive. We’ve entered a new, unstable period that demands better tools to support greater agility, visibility and accuracy in sourcing and supply chain planning and execution.

Regards,

Robert Kugel

SVP & Research Director

example, managing their S&OP processes well. Just 22 percent said they do it well or very well – the same proportion that do it poorly – and half said they do only an adequate job.

example, managing their S&OP processes well. Just 22 percent said they do it well or very well – the same proportion that do it poorly – and half said they do only an adequate job. implications. Understanding trade-offs and consequences improves plan accuracy: Nearly

implications. Understanding trade-offs and consequences improves plan accuracy: Nearly