Fra Luca Pacioli, a 15th-century Franciscan friar living in what’s now Italy, is credited with codifying double-entry bookkeeping, which is the foundation of accounting. Pacioli, a polymath, was well acquainted with his contemporary and fellow polymath Leonardo Da Vinci. So, given they were at times collaborators, it’s fitting that one of the most important applications of SAP’s Leonardo technology will be in helping to disrupt finance and accounting organizations in corporations.

SAP Leonardo is that company’s “digital innovation system,” a catch-all brand that provides business computing services for machine learning (ML) and Artificial Intelligence (AI), big data, analytics, data intelligence, blockchain and the Internet of Things. Combined with SAP’s ERP system, S/4HANA, Leonardo has the potential to move the Office of Finance from being reactive, transactions-oriented and focused on the past to an organization that is more analytical and forward-looking.

This is a transformation that has been predicted many times over the past quarter century but has been thwarted in part by technology limitations. Technology advances provided only incremental gains that did not fundamentally change how the Office of Finance works. This time, things may be different. However, it will happen only if a corporation’s CFO – and ultimately the CEO – is committed to making the change.

SAP’s machine learning capability, for example, can be used to automate the process of matching invoices to payments. Like most eyes-glaze-over accounting department activities, this may not seem like a big deal. However, because the finance function is all about managing masses of small details, the ability to address the myriad of tactical issues that currently consume the department’s energy is ultimately a strategic matter. Not only does this inventory matching eliminate the need for individuals to perform a tedious job (which addresses efficiency issues), when applied to managing receivables it’s a way to identify customer satisfaction issues early (and thus a matter of effectiveness). By resolving these issues early, a company also can reduce its days sales outstanding (a financial effectiveness measure) and promote customer satisfaction. Moreover, by taking humans out of the process, automation significantly reduces process errors, further easing workloads and improving departmental efficiency. Add up these small, incremental efficiency and effectiveness enhancements across the multitude of seemingly inconsequential tasks accountants perform and the result can be impressive – and transformative.

The application of machine learning and artificial intelligence will in part enable this transformation of the finance and accounting department by eliminating or substantially reducing the need for human intervention in rules-based processes such as accounting and tax. This is where Leonardo fits in. I estimate that ML, AI and blockchain have the potential to eliminate about one-third of the repetitive, rules-driven work performed by accounting and tax departments. This will happen as systems automatically process transactions, leaving accounting department personnel to focus on exceptions. In some cases, most of the work will be done by the system. For example, I understand that in tests, SAP has achieved 90 percent first-pass accuracy in matching invoices. In other use cases where there is greater ambiguity, the percentages will of course be lower. Leonardo also includes SAP’s efforts in applying blockchain, an emerging technology. As I’ve commented, blockchain has widespread applications in finance and accounting department processes.

However, the application of machine learning, artificial intelligence and other emerging technologies to the finance and accounting function will only take the department so far. It’s equally important that the ERP system is designed so it enables finance and accounting organizations to rationalize their processes and data to transform how they manage their transactions, planning and analysis. SAP’s S/4HANA ERP software is well aligned with our continuous accounting framework. That is, the software supports a high degree of end-to-end process and data control. A higher degree of control can substantially improve data quality, which reduces the time spent on checking, reconciling and correcting errors. It also eliminates the need for data movement and manipulation by individuals, which wags call “human middleware.”

This shift in the nature of the work performed by the Office of Finance, which puts greater emphasis on providing guidance and analytical support to the rest of the corporation and much less emphasis on processing transactions, has been predicted since the 1990s – inaccurately, as it’s turned out. Many hoped that the percentage of time spent by departments processing transactions would diminish and be replaced by more forward-looking analytical efforts. Structurally this would mean a shift in employment from the accounting department to the financial planning and analysis (FP&A) group. In turn, this was supposed to change the character of the Office of Finance, making it a more strategic to the operations of a company. However, our benchmark research finds that only 10 percent of companies’ finance organizations operate at the highest, innovative quartile while half (51%) are stuck in a tactical role.

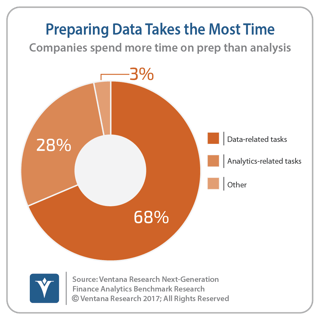

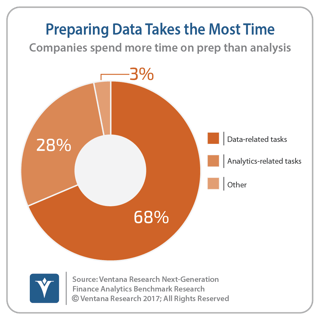

One reason widespread transformation hasn’t happened is that while the financial and analytic software grew incrementally more efficient, it never reached the point of enabling  breakthrough performance. Dashboards and reports became much easier to construct, for instance, but it still took too long to assemble the data going into the reports. Consequently, our finance analytics benchmark research finds that two-thirds (68%) of finance organizations still spend the biggest percentage of their time on assembling, correcting and massaging data. Just 28 percent focus primarily on analytics-related tasks.

breakthrough performance. Dashboards and reports became much easier to construct, for instance, but it still took too long to assemble the data going into the reports. Consequently, our finance analytics benchmark research finds that two-thirds (68%) of finance organizations still spend the biggest percentage of their time on assembling, correcting and massaging data. Just 28 percent focus primarily on analytics-related tasks.

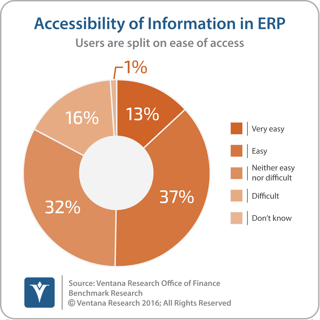

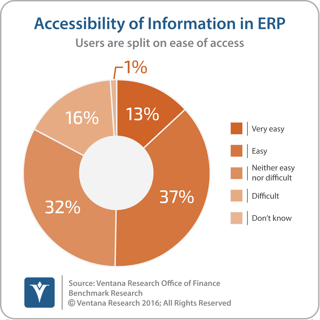

One of the root causes of the amount of time spent on data-related tasks is the availability of data. Our benchmark research finds that only half (50%) of midsize and larger companies said that accessing information from their ERP system is easy or very easy. This, and the time required to prepare data for analysis, is likely an important reason why only one-third (31%) of finance departments say that the information they provide the rest of the business is timely. To address this issue of data availability, SAP offers its universal journal approach), an important step in its ability to provide finance departments with more immediate (even real-time) information from a wider set of data.

The point I want to emphasize is that as important as ML and AI are to the transformation of  finance and accounting, they aren’t enough. Finance and accounting organizations work within the business logic of double-entry bookkeeping. Machine learning and artificial intelligence designed for these business users must operate within this logic and be actionable within an ERP system that can make best use of them. The next step in the evolution of the Office of Finance may be more transformative because it’s taking place as ERP systems undergo a major shift. After more than a decade of steady developments, ERP systems have begun to change fundamentally, facilitated by the growing availability of new technologies including cloud computing, database design, in-memory processing, collaboration, mobility, analytics and planning.

finance and accounting, they aren’t enough. Finance and accounting organizations work within the business logic of double-entry bookkeeping. Machine learning and artificial intelligence designed for these business users must operate within this logic and be actionable within an ERP system that can make best use of them. The next step in the evolution of the Office of Finance may be more transformative because it’s taking place as ERP systems undergo a major shift. After more than a decade of steady developments, ERP systems have begun to change fundamentally, facilitated by the growing availability of new technologies including cloud computing, database design, in-memory processing, collaboration, mobility, analytics and planning.

If Fra Pacioli were alive today, he would codify bookkeeping using today’s technology. Because of its systems design, SAP is among the best-positioned software vendors to support a fundamental transformation of the finance and accounting function over the coming decade. A decade is the right time frame because, notwithstanding the availability of software, it will take time for companies to replace or upgrade their existing ERP software and systems and adjust their processes to take advantage of changes in technology. Because of cost and disruption considerations, companies replace their ERP software only at long intervals – on average, every seven years, according to our research.

The process of selecting an ERP vendor has never been more important because of the changes that have been taking place in the design of – and therefore the capabilities of – ERP systems. Functionality and cost considerations are paramount, but CFOs also must consider how their ERP system will support the changing role of the finance organization well into the next decade. It’s crucial that they understand the importance of technology and system design in selecting an ERP vendor.

In my judgment, SAP is a leader in the application of information technology to the finance function. The combination of its Leonardo-branded AI, ML, blockchain and related technologies with its ERP system design will provide companies and their CFOs with the foundation for creating a more strategic finance and accounting function. I recommend that at this crucial point in the evolution of technologies relevant to their needs, senior finance executives gain a full understanding of how these new technologies will affect them and their roles in the future. Their software evaluation process should assess how vendors will address their departmental requirements for the next 10 years rather than evaluating them on their ability to simply replicate existing processes.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter

and connect with me on LinkedIn.