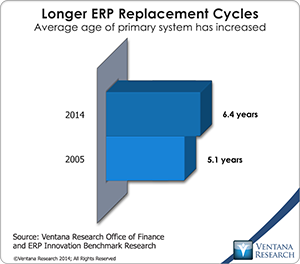

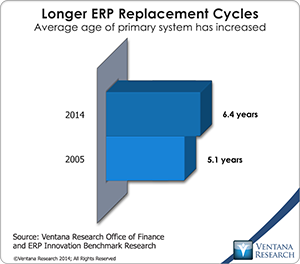

Like most vendors of on-premises ERP and financial management software, in moving to the cloud Oracle has focused on developing for existing and potential customers the option of multitenant software as a service (SaaS). (I’m using the term “ERP” in its most expansive sense, to include such systems employed by all types of companies for accounting and financial management rather than only systems that are used by manufacturing and distribution companies.) Oracle’s ERP Cloud Service includes Fusion Financials as well as planning and budgeting, risk and controls management, procurement and sourcing, inventory and cost management, product master data management, and project portfolio management. Although to date our benchmark research has consistently found that a large majority of finance departments do not prefer to deploy software in the cloud, we also observe the balance shifting in this direction. SaaS vendors that address finance department requirements have demonstrated faster revenue growth than those that offer products only on-premises. Like other vendors Oracle must establish itself as a credible vendor of cloud ERP and financial management services to be well positioned as market demand shifts further in that direction. The company made sizable investments in acquiring ERP and financial management software in the 2000s (notably PeopleSoft – which included JD Edwards – and Hyperion), and the investments have paid off as many companies have opted to keep their existing systems (and continue to pay maintenance) rather than replace them. Our Office of Finance benchmark research finds that over the past decade the average age of ERP systems in use has increased to 6.4 years from 5.1 years. The longevity of these systems is partly the result of the slow pace of innovation in underlying technologies used for business computing. Even so, modest year-by-year changes are adding up to make replacement a more attractive option while negative attitudes toward the cloud are dissipating. To retain its installed base, it’s important for any established vendor to have solid customer references and the ability to make sales of cloud products as demand for ERP and financial management software in the cloud increases.

Like most vendors of on-premises ERP and financial management software, in moving to the cloud Oracle has focused on developing for existing and potential customers the option of multitenant software as a service (SaaS). (I’m using the term “ERP” in its most expansive sense, to include such systems employed by all types of companies for accounting and financial management rather than only systems that are used by manufacturing and distribution companies.) Oracle’s ERP Cloud Service includes Fusion Financials as well as planning and budgeting, risk and controls management, procurement and sourcing, inventory and cost management, product master data management, and project portfolio management. Although to date our benchmark research has consistently found that a large majority of finance departments do not prefer to deploy software in the cloud, we also observe the balance shifting in this direction. SaaS vendors that address finance department requirements have demonstrated faster revenue growth than those that offer products only on-premises. Like other vendors Oracle must establish itself as a credible vendor of cloud ERP and financial management services to be well positioned as market demand shifts further in that direction. The company made sizable investments in acquiring ERP and financial management software in the 2000s (notably PeopleSoft – which included JD Edwards – and Hyperion), and the investments have paid off as many companies have opted to keep their existing systems (and continue to pay maintenance) rather than replace them. Our Office of Finance benchmark research finds that over the past decade the average age of ERP systems in use has increased to 6.4 years from 5.1 years. The longevity of these systems is partly the result of the slow pace of innovation in underlying technologies used for business computing. Even so, modest year-by-year changes are adding up to make replacement a more attractive option while negative attitudes toward the cloud are dissipating. To retain its installed base, it’s important for any established vendor to have solid customer references and the ability to make sales of cloud products as demand for ERP and financial management software in the cloud increases.

Oracle also has faced a broader marketing challenge because it is seen by some industry observers as being late in having a cloud offering and as not being a “real” cloud vendor. On this last point, some IT analysts (and certainly “real” cloud vendors) draw a sharp line between incumbent, on-premises vendors and the newer cloud-based ones. Yet strict definitions of what qualifies as the cloud are becoming less relevant to the market generally and to business buyers in particular. Moreover, the issue of which company is a “real” cloud vendor will become increasingly less important to users of cloud-based systems over the next five years as software environments evolve to a hybrid cloud model that combines multitenant, single tenant and on-premises deployments. As I’ve noted, I don’t believe that cloud vs. on-premises is a binary situation. Finance departments are likely to take a hybrid approach to sourcing software that best suits their needs. As tools that integrate cloud and on-premises systems improve, more companies will elect to deploy some – but not all – parts of their core financial systems in the cloud. For example, in the early 2000s corporations began to switch deployment of their travel and expense management software to the cloud; today very few run this application on-premises. Moreover, I don’t expect cloud ERP to completely displace on-premises installations. One reason is the substantial challenges that SaaS vendors will need to address to make their software more configurable to reach the widest possible market.

Since it wasn’t a first mover in the market, Oracle has needed to apply its products’ strengths to its cloud offerings and take advantage of its market position to generate new sales. It is differentiating its financial cloud offerings by building on substantial depth and breadth of functionality and existing vertical specialization across multiple industries – although not manufacturing and distribution, which almost always require a much higher degree of configurability than services businesses. Oracle also offers Hyperion Planning as part of its cloud offering, simplifying integration between planning and ERP systems. In the past, Oracle has touted the strong capabilities of its ERP and financial management software, but to acquire many of these meant purchasing the entire stack from Oracle, notably its middleware and database; this limited its appeal. The cloud-based offerings are built on the Oracle full stack, which facilitates provisioning, configuration, synchronization and process and data integration of the cloud-based elements, as well as integration with existing on-premises Oracle systems and, to some extent, other vendors’ systems. Oracle’s architecture also facilitates multidimensional reporting without a separate data warehouse, which provides users with considerable utility without added investment.

In the near term, Oracle is likely to be most successful in selling its SaaS offerings to its installed base, either in adding some process or functional capability or as a “tier two” ERP system used in smaller or remote locations or business units. Selling subscriptions to existing customers also is likely to be more profitable in the near term than attracting new ones because for software companies the sales and costs associated with adding contracted products and services for existing customers typically are lower than adding new customers. Selling to larger companies can be more profitable than selling to midsize ones, which almost always have higher ratios of contract acquisition costs to contract value. Both sizes of companies require about the same sales effort, but contract values tend to be higher for large corporations. From the customer’s perspective, adding or replacing existing on-premises functionality with a cloud-based version may be attractive financially or the result of a corporate decision to offload management of its general portfolio of software from the IT department to concentrate on systems that are strategic to the company. The latter may include, for example, Oracle’s project portfolio management functionality, which can be used to manage professional services organizations. Many industrial manufacturing and business services companies have a consulting group that customers employ to assist in making use of the product or service (such as with design, implementation or engineering consulting). It’s much easier to handle these sorts of operations with a single application that manages in an integrated fashion the operational elements (scheduling, time and costs tracking and task management, for example) as well as the financial aspects. Web-based software for managing professional services is particularly well suited to the needs of companies in which professional services are only part of the overall product line because it may be less expensive than using an on-premises approach. Moreover, since Oracle has integrated mobile capabilities, it suits the needs of professionals who spend most of their time in the field with customers. Other add-on functionality capabilities useful to existing customers and attractive in the cloud include revenue management (Oracle’s software is aimed at high-tech companies), procure-to-pay for nonstrategic (indirect) items, sourcing and contract management and product item master management.

Tier-two systems offer another opportunity. In the 1990s, larger corporations that operate in geographically dispersed areas began to standardize the ERP software they use in remote locations with few employees or in offices they could not support their main ERP system. These “tier two” systems typically were software packages designed for midsize companies because they were easier and less costly to implement and maintain. For global organizations, Oracle’s software has localization for more than 50 countries and supports 23 languages. It is also designed to support country-specific statutory accounting and tax requirements as well as enable management of centralized payments and receipts across multiple legal entities and business units. Cloud ERP is well suited to tier-two use. Often, it is attractive because it requires no on-site servers or software that require maintenance and upgrades. Cloud-based systems also make it easier to maintain financial and IT controls such as separation of duties, change management and IT security because potential intruders don’t have physical access to the applications and hardware. The downside is that they also require integration at process and data levels to operate efficiently.

Stressing Oracle’s opportunity to sell to existing customers is not meant to downplay its opportunity in the cloud ERP market. However, as with all other SaaS ERP vendors, its long-term success will depend on how easy it is to configure a system to the needs of the broadest set of users. Multitenant cloud offerings are inherently more economical than single-tenant configurations, and these savings provide a compelling reason to acquire software in this format. The flip side of that is that many companies – especially those in manufacturing or production of physical goods – find that cloud ERP systems do not offer enough flexibility in their configuration to meet their business needs. (This is one reason why Oracle does not address this market now.) While cloud-based ERP has been a hot market, expanding rapidly over the past 10 years, a majority of ERP deployments remain on premises. So the rapid growth in the cloud segment has been driven by the superior economics for buyers that are able to accept the software’s limited configurability and by growing midsize companies that can migrate from entry-level accounting software sooner than was practical with on-premises software.

Stressing Oracle’s opportunity to sell to existing customers is not meant to downplay its opportunity in the cloud ERP market. However, as with all other SaaS ERP vendors, its long-term success will depend on how easy it is to configure a system to the needs of the broadest set of users. Multitenant cloud offerings are inherently more economical than single-tenant configurations, and these savings provide a compelling reason to acquire software in this format. The flip side of that is that many companies – especially those in manufacturing or production of physical goods – find that cloud ERP systems do not offer enough flexibility in their configuration to meet their business needs. (This is one reason why Oracle does not address this market now.) While cloud-based ERP has been a hot market, expanding rapidly over the past 10 years, a majority of ERP deployments remain on premises. So the rapid growth in the cloud segment has been driven by the superior economics for buyers that are able to accept the software’s limited configurability and by growing midsize companies that can migrate from entry-level accounting software sooner than was practical with on-premises software.

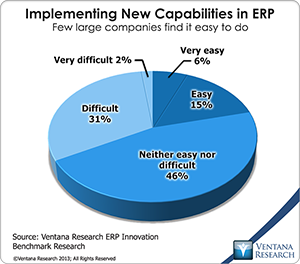

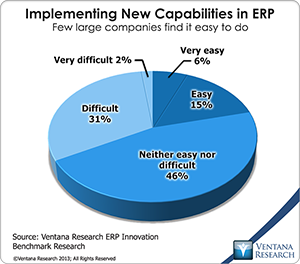

The biggest challenge – and greatest opportunity – in the ERP software market lies in developing a multitenant cloud ERP offering that provides ample functionality and configurability to address the requirements of a majority of the market. Just one in five companies in our research said that it is easy or very easy to implement new capabilities in their ERP system; one-third said it is difficult or very difficult. The root cause of the difficulty is the forms-based table structure almost all ERP systems use. The first generations of all business computing systems were created as analogs to existing paper-based systems, similar to the way that the first automobiles were “horseless carriages” in their configuration. ERP systems also have mimicked the multiple ledger structure of paper-based accounting systems (which is pointless and even counterproductive in a computer-based system) and the paper-based forms that are the information containers used in accounting processes. In the first stages of business process automation, this simplistic automation was the only practical approach since it was the easiest way for programmers to start. But just as the design of cars evolved into a totally new form to reflect the capabilities of the underlying technologies, business computing systems have to evolve to break out of the shackles imposed by paper analog structures.

To break the configurability barrier ERP systems have to be more flexible in their basic design. Ideally, they should eliminate the need for customizing the underlying application. Companies would benefit if modifications are easier - and potentially less expensive - to make initially and to adjust as business conditions change over time. Easier configurability also can make it possible to reconfigure processes and capabilities faster and more cheaply than is possible today, enabling companies to make their ERP system more adaptable to their business needs. Separating the individual configurations from the core code base means that SaaS vendors can give a much broader set of users the flexibility they need to make the system work as they wish while maintaining only a single instance of a code base to modify, upgrade, debug and patch. A more configurable system also has the advantage of being easier to upgrade in an on-premises deployment and possibly easier to implement in the first place. To remain a leading vendor in ERP in the coming decade, Oracle, like all other ERP software vendors, will need to evolve its software into an attractive choice in the multitenant cloud for an ever widening market by making the software as configurable as possible to reduce the level of consulting and customization required.

Regards,

Robert Kugel – SVP Research

Stressing Oracle’s opportunity to sell to existing customers is not meant to downplay its opportunity in the cloud ERP market. However, as with all other SaaS ERP vendors, its long-term success will depend on how easy it is to configure a system to the needs of the broadest set of users. Multitenant cloud offerings are inherently more economical than single-tenant configurations, and these savings provide a compelling reason to acquire software in this format. The flip side of that is that many companies – especially those in manufacturing or production of physical goods – find that cloud ERP systems do not offer enough flexibility in their configuration to meet their business needs. (This is one reason why Oracle does not address this market now.) While cloud-based ERP has been a hot market, expanding rapidly over the past 10 years, a majority of ERP deployments remain on premises. So the rapid growth in the cloud segment has been driven by the superior economics for buyers that are able to accept the software’s limited configurability and by growing midsize companies that can migrate from entry-level accounting software sooner than was practical with on-premises software.

Stressing Oracle’s opportunity to sell to existing customers is not meant to downplay its opportunity in the cloud ERP market. However, as with all other SaaS ERP vendors, its long-term success will depend on how easy it is to configure a system to the needs of the broadest set of users. Multitenant cloud offerings are inherently more economical than single-tenant configurations, and these savings provide a compelling reason to acquire software in this format. The flip side of that is that many companies – especially those in manufacturing or production of physical goods – find that cloud ERP systems do not offer enough flexibility in their configuration to meet their business needs. (This is one reason why Oracle does not address this market now.) While cloud-based ERP has been a hot market, expanding rapidly over the past 10 years, a majority of ERP deployments remain on premises. So the rapid growth in the cloud segment has been driven by the superior economics for buyers that are able to accept the software’s limited configurability and by growing midsize companies that can migrate from entry-level accounting software sooner than was practical with on-premises software.