Analytics has long been a core discipline of Finance, applied to analysis of balance sheets, income statements and cash-flow statements. However, as I’ve noted, most finance departments have not kept up with recent advances. Our recent research in finance analytics shows that few organizations are realizing the potential of more advanced analytic methods and tools such as predictive analytics and driver-based modeling. One reason for this sluggishness is that they have not looked past yesterday’s requirements to see what possible. Another is that they are distracted by the difficulties they face in simply doing tried-and-true analysis, which is the result of difficulties in accessing the necessary data and inadequate tools. A third reason is that people receive too little training in the application of analytics to business and the use of more advanced analytic tools and methods.

Analytics has long been a core discipline of Finance, applied to analysis of balance sheets, income statements and cash-flow statements. However, as I’ve noted, most finance departments have not kept up with recent advances. Our recent research in finance analytics shows that few organizations are realizing the potential of more advanced analytic methods and tools such as predictive analytics and driver-based modeling. One reason for this sluggishness is that they have not looked past yesterday’s requirements to see what possible. Another is that they are distracted by the difficulties they face in simply doing tried-and-true analysis, which is the result of difficulties in accessing the necessary data and inadequate tools. A third reason is that people receive too little training in the application of analytics to business and the use of more advanced analytic tools and methods.

Companies typically do not provide training – or testing – to enhance the analytical skills of their employees. Testing skills is useful in exposing individual and organizational gaps and injects motivation into the training process. Creating analytics requires a thorough knowledge of the basics: which methods to use under which circumstances and the best approaches to take. Newer analytic approaches and tools can be complex, so it makes sense to train people to gain a better understanding of both the basic uses of analytic tools and advanced analytics. Yet the research shows that fewer than one-third (31%) of companies provide training for people who create analytics. This may be because organizations hire people who they assume already have the skills or the talent to pick them up as needed on the job. They also may be reluctant to spend money and unaware of the indirect expenses of not doing so. Because they rarely test employee skills, organizations may not be aware of the shortfalls in competence that are costing them time and money. For whatever reason, the lack of training – especially in the creation of analytics – is shortsighted.

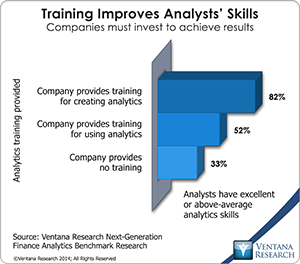

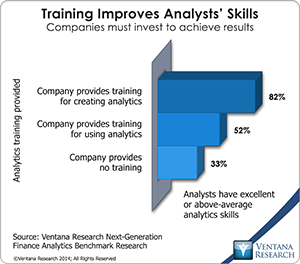

Training is vital to building analysts’ skills, especially for creating analytics. The research demonstrates a correlation. We found that a large majority (83%) of the companies that provide training in creating analytics have staffs whose skills they deem excellent or above average, compared to only half (52%) of those that provide training only in using analytics and just one-third of those that provide no training at all.

Training is vital to building analysts’ skills, especially for creating analytics. The research demonstrates a correlation. We found that a large majority (83%) of the companies that provide training in creating analytics have staffs whose skills they deem excellent or above average, compared to only half (52%) of those that provide training only in using analytics and just one-third of those that provide no training at all.

Companies that fail to test individual skills are unlikely to discover the link between weak skills and poor performance. People may complete their assignments but take twice as long as necessary to do them. If the analysts are using spreadsheets, they may be constructing models and analyses that have unseen errors (as they did in the infamous London Whale episode) or needlessly complex models because they are unfamiliar with built-in functions that simplify tasks.

Training those who create analytics also helps ensure that time spent on analytics is used as effectively as possible. In about half (47%) of the companies that train analytics creators, people spend the largest amount of their time where they should – in working with the analytics to get answers or model business issues and analysis – compared to 27 percent of organizations that only provide training for users and 20 percent that provide no training. In about three-fourths of companies that provide only training for users (73%) or no training (76%), they spend the largest amount of time on data-related tasks (waiting for data, preparing it and reviewing it for errors) rather than on analysis. Fully half of companies that provide training for creators also use analytics and performance indicators to improve individual or business unit performance, many more than those that train only users (20%) or provide no training (17%).

Analytics can be a valuable tool for finance departments and can help them play more significant roles in their organizations, which many finance professionals now want to do. But until more of them make the often extensive changes and investments the research shows they need, this goal will be more of a hope than a promise. Training finance professionals in the creation and use of both basic and advanced analytics is essential for companies to improve their performance. Being prepared and training is the best path to be effective in finance analytics.

Regards,

Robert Kugel – SVP Research

Analytics has long been a core discipline of Finance, applied to analysis of balance sheets, income statements and cash-flow statements. However,

Analytics has long been a core discipline of Finance, applied to analysis of balance sheets, income statements and cash-flow statements. However,