Many finance executives want to improve their department’s effectiveness in order to play a more strategic role in their company. However, frequently they find at least three serious challenges to achieving this sort of finance transformation. One is that too much time and resources are devoted to purely mechanical tasks. Another is that the information executives need is not always available immediately. A third is that they lack the data (which is unavailable or too difficult to access), the analytic tools or both to do rapid contingency planning. One area in the Office of Finance that needs particular attention is treasury, as I commented recently. Treasury management is a challenge because it’s highly detailed and demands complete accuracy. These requirements make it an area that can benefit from more automation.

Ventana Research recently named Kyriba for Kyriba Enterprise the  winner of our 2013 Financial Management Innovation Award. Kyriba offers a suite of Web-based software for treasury management that automates processes and data management and provides tailored analytics and self-service reporting for the treasury function. Kyriba Enterprise, its core product, manages cash, payments, financial transactions and bank relationships as well as risk management, including counterparty risk. Its “supply chain finance” capabilities facilitate payment of suppliers and optimize cash and credit. In order to make good decisions consistently in this area, organizations require better intelligence to weigh options for deploying cash balances and managing debt levels (by currency and location) as well as to make tactical decisions on whether to accelerate payment of invoices to take advantage of discounts.

winner of our 2013 Financial Management Innovation Award. Kyriba offers a suite of Web-based software for treasury management that automates processes and data management and provides tailored analytics and self-service reporting for the treasury function. Kyriba Enterprise, its core product, manages cash, payments, financial transactions and bank relationships as well as risk management, including counterparty risk. Its “supply chain finance” capabilities facilitate payment of suppliers and optimize cash and credit. In order to make good decisions consistently in this area, organizations require better intelligence to weigh options for deploying cash balances and managing debt levels (by currency and location) as well as to make tactical decisions on whether to accelerate payment of invoices to take advantage of discounts.

One of the most important reasons to automate the treasury function is that it improves a company’s forward visibility into its cash and liquidity. Because business is dynamic, forecasts of a company’s short-term finances are constantly changing, so it’s important that projections can be updated quickly, consistently and accurately. Visibility and the ability to understand the impact of contingencies are critical in the decision-making process, which is why having a tool that can rapidly assess potential outcomes to various scenarios is important. As well, given the importance of cash and liquidity to the day-to-day functioning of a business, financial executives must be able to exercise full control over these assets. Treasury must also be productive, which is why a tool that improves its efficiency through automation and better data management is essential. With today’s low interest rates, paying early to get a price discount offers companies a high rate of return on their cash. However, many companies fail to take advantage of this (or fail to do so consistently) because they don’t have the tools or processes to ensure that valid invoices are paid promptly.

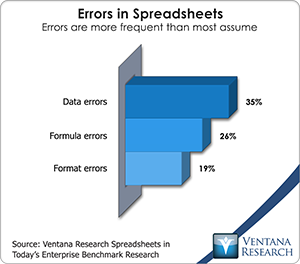

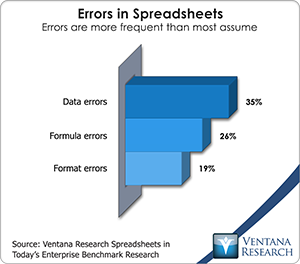

Treasury management software has been around for decades, but many companies still use desktop spreadsheets exclusively or for parts of this finance department function. Reducing the use of desktop spreadsheets in treasury diminishes associated risks, notably errors. Our spreadsheet research shows that data and formula errors are relatively common: More than one-third (35%) of participants said that errors are common in the most important spreadsheets they use in their jobs, and about one-fourth (26%) said that they find errors in formulas.

Treasury management software has been around for decades, but many companies still use desktop spreadsheets exclusively or for parts of this finance department function. Reducing the use of desktop spreadsheets in treasury diminishes associated risks, notably errors. Our spreadsheet research shows that data and formula errors are relatively common: More than one-third (35%) of participants said that errors are common in the most important spreadsheets they use in their jobs, and about one-fourth (26%) said that they find errors in formulas.

Kyriba offers Web-based software as a service (SaaS). For treasury management, SaaS has several advantages, including anytime, anywhere access to data, which can be critically important when issues arise outside of normal business hours or when key people are out of the office. In addition, implementation can be rapid and requires a limited amount of upfront investment. Kyriba Enterprise requires no ongoing IT department support, and for larger organizations it can scale to their requirements. The company also has the requisite security certifications, which can offer an even more secure environment than a company’s own infrastructure.

Making the finance department more strategic usually starts with finding ways to automate as many routine functions and processes as possible, and managing data to ensure its accuracy, availability and consistency. This frees up resources that can be redeployed to do more valuable work. Dedicated software often plays a key role in automating core business processes, managing tasks and handling data. With the right software, treasury organizations can help transform finance departments by providing more immediate, reliable information, as well as analytics-based insights to support consistently better decision-making and improved efficiency. Finance executives who want to improve their treasury organization should evaluate how well their existing technology supports this function. If better software is needed, I recommend evaluating Kyriba Enterprise.

Regards,

Robert Kugel – SVP Research