Planful recently acquired Plannuh, a marketing-performance management application, to integrate into the Planful platform so that organizations can connect their marketing planning and analysis group with the finance department. There’s the old story of a CEO who said, “I know half my marketing spend is wasted, I just don’t know which half.” Plannuh is designed to answer that question.

Since 2007, Ventana Research has advocated what we call integrated business planning (IBP) to unify planning processes across the enterprise to improve performance. IBP is a high-participation, collaborative, action-oriented approach to planning and budgeting built on frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes. I have advocated for financial planning and analysis (FP&A) groups to expand their mission to actively support more effective planning and performance management across all parts of the organization which, in practice, means providing them with the ability to reduce the time and effort needed to create and update plans as well as streamline the analysis of results to assess their performance against those plans. I assert that by 2025, one-fourth of FP&A organizations will have implemented IBP, bringing together operational and financial planning on a single platform to improve the business value of planning and budgeting.

frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes. I have advocated for financial planning and analysis (FP&A) groups to expand their mission to actively support more effective planning and performance management across all parts of the organization which, in practice, means providing them with the ability to reduce the time and effort needed to create and update plans as well as streamline the analysis of results to assess their performance against those plans. I assert that by 2025, one-fourth of FP&A organizations will have implemented IBP, bringing together operational and financial planning on a single platform to improve the business value of planning and budgeting.

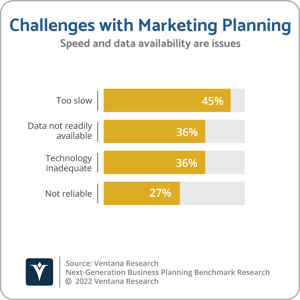

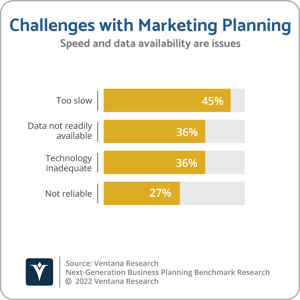

Marketing departments have to plan specific elements of an organization’s go-to-market with the objective of achieving the most effective use of their budget to generate revenue in the short-, medium- and long-term. Plannuh is designed to help marketing executives create a set of measurable, operational and financial objectives related to campaigns and assess performance against those metrics. By assessing how well those objectives are met, and having the ability to continually refine plans to reflect those results and real-world conditions, marketing departments can enhance the effectiveness of their campaigns and spending, adjusting goals and reallocating marketing spend when necessary to achieve them. Our Next-Generation Business Planning Benchmark Research finds that 45% of participants said their marketing planning process is too slow and 36% said that data is not readily available.

Plannuh is designed to facilitate the adoption of an effective marketing planning-and-performance management system by offering marketing executives a planning framework designed specifically for their needs, one that simultaneously captures relevant metrics and cost data across an entire organization. These metrics relate to cost-per-outcome, ROI and customer lifetime value, and by connecting marketing and financial data in near real time, results can be assessed quickly and adjustments made when necessary. Having a better understanding of where marketing spend is not achieving desired results helps departments create a more effective budget. It begins to answer the question: which half of the marketing budget is wasted.

across an entire organization. These metrics relate to cost-per-outcome, ROI and customer lifetime value, and by connecting marketing and financial data in near real time, results can be assessed quickly and adjustments made when necessary. Having a better understanding of where marketing spend is not achieving desired results helps departments create a more effective budget. It begins to answer the question: which half of the marketing budget is wasted.

A major challenge of IBP is connecting the relevant performance measures of a department to the organization of the general ledger — the specific accounts the finance department uses to book transactions. This is especially true for marketing because many of its activities span multiple cost centers in the chart of accounts. The software handles the details, grouping sets of expenditures related to campaigns, splitting expenses across budget units and functions, and even getting down to assigning detailed general ledger codes, purchase order numbers and invoice data to campaigns and budget owners for a complete view of how money has been spent and the impact it has had. The ability to support a structured dialog (one where ideas, questions and assertions are quantified with data) enables marketing executives to better communicate, grounding what otherwise might seem nebulous in the language of finance and accounting.

Even in the best of times, marketing executives can find it difficult to justify their budget requests. Faced with inflation-driven cost pressures, companies often reduce investments in marketing because of the uncertain effectiveness of the spend. Including marketing as part of a rigorous planning process, one where outlays are justified by measurable results and financial impact, can help marketing executives to justify budgets in both challenging and normal times. Planful is designed for midsize and smaller enterprise organizations, those where enabling the relatively easy fusion of marketing and financial data to manage marketing performance can be especially useful. I recommend that midsize organizations that are thinking about adopting a planning platform consider Planful for that role, especially if they wish to make their marketing budgets more effective.

Regards,

Robert Kugel

frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes. I have advocated for

frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes. I have advocated for  across an entire organization. These metrics relate to cost-per-outcome, ROI and customer lifetime value, and by connecting marketing and financial data in near real time, results can be assessed quickly and adjustments made when necessary. Having a better understanding of where marketing spend is not achieving desired results helps departments create a more effective budget. It begins to answer the question: which half of the marketing budget is wasted.

across an entire organization. These metrics relate to cost-per-outcome, ROI and customer lifetime value, and by connecting marketing and financial data in near real time, results can be assessed quickly and adjustments made when necessary. Having a better understanding of where marketing spend is not achieving desired results helps departments create a more effective budget. It begins to answer the question: which half of the marketing budget is wasted.