We find in our recent Change in the Office of Finance benchmark research an indication of the value of using automation to execute finance department functions. Our findings reveal an increase in the use of automation by finance organizations over the past five years and a concomitant improvement in performance. For example, 46 percent of companies close their monthly books within four business days compared to 29 percent in our earlier research. Yet the glass is only half full. Finance organizations continue to be laggards in adopting technology that measurably improves effectiveness.

Automated systems do at least two things very well that make better use of people’s time, and both of them can substantially improve organizational performance. First,  they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires their experience, judgment and skill. IT systems also can be programmed to present only relevant information while eliminating the need to get immersed in detail. The latter capability supports a “management-by-exception” approach, which enables executives and managers to better allocate how and where they spend their time.

they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires their experience, judgment and skill. IT systems also can be programmed to present only relevant information while eliminating the need to get immersed in detail. The latter capability supports a “management-by-exception” approach, which enables executives and managers to better allocate how and where they spend their time.

Our research shows that many companies don’t take advantage of these capabilities in their finance and accounting operations. Only half of participating organizations said they have automated a significant percentage of their finance processes. In particular, only one-fourth (25%) have nearly or fully automated their financial close, while 58 percent apply some automation and 15 percent apply little or none.

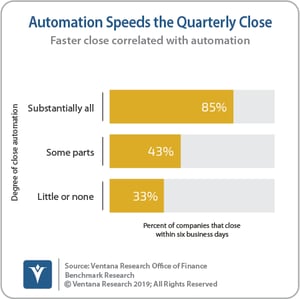

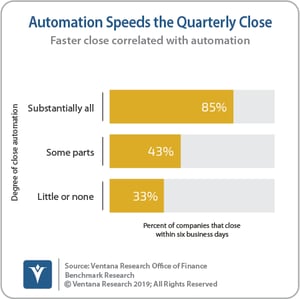

The research also reveals automation’s positive impact on performance: 85 percent of companies that nearly or fully automate their close process are able to close their quarterly books in six or fewer business days, whereas 43 percent of those that have only partially automated are able to do so and just 33 percent that use little or no automation have this ability.

Another example is the automation of reconciliation, a repetitive task that is an essential element of the close process and lends itself to automation. Affordable software for managing it is available and now mature. Our research finds a significant increase since 2014 in the percentage of organizations that automate reconciliations: 60 percent report using software to automate the reconciliation process compared to 37 percent five years earlier. Automation of reconciliation also correlates with how quickly an organization closes its books: 60 percent of organizations that use software for this purpose close their quarters within six business days. By contrast, nearly two-thirds (62%) that do not automate reconciliation take seven or more working days to close.

Spreadsheets are an essential tool for many tasks in the finance department, and it would be impossible for the organization to function without them. Yet they are the wrong choice when used for repetitive, collaborative, enterprise-wide processes. Indeed, they are both a symptom and a cause of dysfunctional processes, systems and data. Spreadsheets are a symptom because they frequently become the default option to put a bandage over, for example, issues that arise because systems are not properly integrated or a process is not supported by the appropriate technology, such as a dedicated application.

But while spreadsheet use in enterprise processes has declined relative to the use of dedicated applications, they remain a fixture for a variety of finance department tasks. For instance, 57 percent of organizations still use them for treasury management (down from 81% five years earlier); 54 percent use them for close-to-report functions (versus 79%); and 59 percent use them for the income tax provision (versus 86%). Spreadsheets have their place, but our research demonstrates that they are frequently misused.

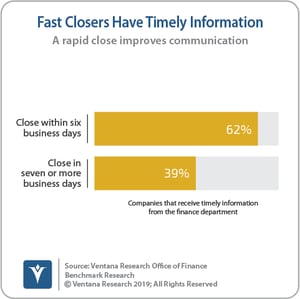

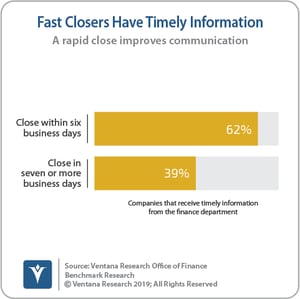

The close is a useful process to benchmark because almost every company does it and there’s a measurable outcome: the number of days after the period’s end in which the company completes the process. However, managing to a faster close is not just about efficiency; it’s also about getting the numbers to executives and managers so they can react quickly to issues and opportunities. The research demonstrates a close correlation between when the close is completed and the timeliness of communicating that information to the rest of the company. Almost two-thirds (62%) of organizations that close within six business days are able to provide executives and managers with timely information compared to 39 percent of those that take longer. While the acceleration we found in completing the close is a positive sign, there is considerable progress yet to be made.

Time is the critical ingredient that determines the overall performance of finance and  accounting departments. Poorly performing organizations usually are mired in an endless cycle of fighting fires — for example, dealing with the impact of processes that are poorly designed or improperly executed. These departments are constantly contending with the impact of information sources that are unreliable, difficult to access or both. Poorly designed systems add to the problem, generating hours of work in the form of manual reconciliations done in spreadsheets. A finance department that does not apply automation and that has poorly designed or executed processes and systems is similar to a caged hamster running on a wheel. It expends a great deal of effort on repetitive manual processes that are only marginally productive.

accounting departments. Poorly performing organizations usually are mired in an endless cycle of fighting fires — for example, dealing with the impact of processes that are poorly designed or improperly executed. These departments are constantly contending with the impact of information sources that are unreliable, difficult to access or both. Poorly designed systems add to the problem, generating hours of work in the form of manual reconciliations done in spreadsheets. A finance department that does not apply automation and that has poorly designed or executed processes and systems is similar to a caged hamster running on a wheel. It expends a great deal of effort on repetitive manual processes that are only marginally productive.

Software automation by itself will not address all the challenges of a finance and accounting organization. To optimize performance, an organization almost always must deal with an interrelated combination of people, process, technology and data issues in a holistic fashion. Yet confronted with the day-to-day struggle of meeting deadlines, many finance executives put off addressing their productivity and effectiveness issues.

They shouldn’t, because a continuous improvement process involving a steady set of small advances can yield impressive results over time. Identifying — and when possible, eliminating — the biggest time sinks can free up the resources needed to address the next set of significant problems. Even something as straightforward as uncovering unnecessary work or replacing the most problematic spreadsheets with better technology (for instance, implementing automated or self-service reporting) will be beneficial. For this to happen, though, senior finance and accounting executives must make automation a priority.

Regards,

Robert Kugel

they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires their experience, judgment and skill. IT systems also can be programmed to present only relevant information while eliminating the need to get immersed in detail. The latter capability supports a “management-by-exception” approach, which enables executives and managers to better allocate how and where they spend their time.

they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires their experience, judgment and skill. IT systems also can be programmed to present only relevant information while eliminating the need to get immersed in detail. The latter capability supports a “management-by-exception” approach, which enables executives and managers to better allocate how and where they spend their time. accounting departments. Poorly performing organizations usually are mired in an endless cycle of fighting fires — for example, dealing with the impact of processes that are poorly designed or improperly executed. These departments are constantly contending with the impact of information sources that are unreliable, difficult to access or both. Poorly designed systems add to the problem, generating hours of work in the form of manual reconciliations done in spreadsheets. A finance department that does not apply automation and that has poorly designed or executed processes and systems is similar to a caged hamster running on a wheel. It expends a great deal of effort on repetitive manual processes that are only marginally productive.

accounting departments. Poorly performing organizations usually are mired in an endless cycle of fighting fires — for example, dealing with the impact of processes that are poorly designed or improperly executed. These departments are constantly contending with the impact of information sources that are unreliable, difficult to access or both. Poorly designed systems add to the problem, generating hours of work in the form of manual reconciliations done in spreadsheets. A finance department that does not apply automation and that has poorly designed or executed processes and systems is similar to a caged hamster running on a wheel. It expends a great deal of effort on repetitive manual processes that are only marginally productive.