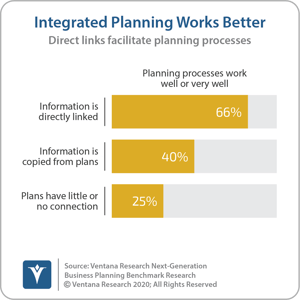

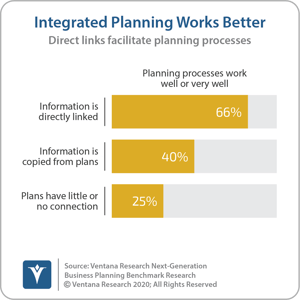

The objectives of zero-based budgeting are well aligned with what I call integrated business planning, a technology-enabled approach to managing the forward-looking activities of a corporation including forecasting, planning and budgeting. IBP enables every business unit to plan their business in a way that makes sense to them but also makes the numbers in those plans available for company-wide planning, budgeting analysis and reporting. IBP combines operational planning and financial budgeting using models constructed around the things that managers manage, translating those elements into a financial budget. This approach can compress the time required to create and update operating plans from days or weeks to hours or minutes. Our Next-Generation Business Planning Benchmark Research found that IBP is a superior approach.

By focusing planning and review discussions between executives and managers on the operational aspects of the plans, the process becomes more relevant to achieving business objectives and improving operational performance. Targets for Individual business units are set in both operational and financial terms: The focus is on business objectives while the financial consequences of the plan serve as a constraining objective and control mechanism rather than sole objective of the process.

By focusing planning and review discussions between executives and managers on the operational aspects of the plans, the process becomes more relevant to achieving business objectives and improving operational performance. Targets for Individual business units are set in both operational and financial terms: The focus is on business objectives while the financial consequences of the plan serve as a constraining objective and control mechanism rather than sole objective of the process.

Zero-based budgeting first received widespread attention in the 1970s when the approach was promoted by President Carter for the U.S. federal budget. It is “zero-based” because, rather than building a rationale for a budget in terms of percentage changes from the prior period, every business unit must fully justify every amount from a zero base. This method is a direct response to the less-than-optimal results produced by a budget-driven mindset. With a budget-driven approach, rather than detail the resources necessary to achieve their objectives, it is simpler for a business unit manager to first calculate how much of a budget increase he or she wants to ask for and then create high-level resource requirements to justify the budget. Starting from the previous period’s allocations, budget owners negotiate incremental changes without having to justify whether the money allocated in the previous year was spent well or if the coming year’s increase is necessary and justified.

ZBB was not warmly received at either the federal or corporate level and quickly faded from view. However, this form of budgeting became a fashionable topic again in the past decade as executives sought to trim unnecessary costs. But zero-based budgeting is still a finance-centric approach that has limited business and operational value. IBP achieves the same goal as ZBB but it does much more.

Integrated business planning combines operational planning and budgeting so that the process is not just a negotiation about abstract financial figures but is centered on business requirements and how best to address them. The approach is consistent with the objectives of zero-based budgeting because it makes it possible to tie specific resources to specific outcomes, creating the business case for each operational element of the plan and the associated budget for those elements.

In essence, budgets derived from such planning are built from the ground up. If volumes are projected to be generally flat in a business unit, then the resources necessary to support these volumes ought to be unchanged. The financial budget would differ from the prior period only to the extent that prices are expected to change. For example, if a 9% overall rise in salaries, wages, benefits and employment taxes is expected by human resources but executives will only allow a 4% increase in the headcount budget, the focus of the negotiation between executives and the manager would be about the possibility of achieving the same output with fewer resources and how that is to be accomplished. If productivity benchmarks suggest that the business unit is not as efficient as it could be, the discussion would be about where and how to trim headcount and other resources to meet the limited increase. If the business unit is clearly operating at peak efficiency, the result of the discussion ideally would be to raise the headcount budget to a 9% increase because evidence shows that it is necessary.

IBP also makes budgeting easier for the budget owner. Technology has made the mechanics of planning and budgeting more efficient, yet one of the consistent complaints from budget owners is that the process provides little value to them. Almost two-thirds of those participating in our Benchmark Research say that it takes too long. Almost one-half say it’s not adaptable or flexible enough, that it’s too political and in the end, it’s senior management’s budget or the finance department’s budget.

To make the process easier, finance, planning and analysis organizations also need to model and measure the “things,” or resources, that budget owners use to achieve their business objectives, not just recoup their monetary value. When budget owners plan and budget, they usually think in terms of the things they need to run their part of the business, such as headcount, advertising campaigns, facilities, laptops, etc. The budgeting system must be able to simultaneously translate this list of resources into accounting line items so the system can aggregate the financial data into a company-wide budget and financial forecast. Having headcount plans automatically generate a detailed headcount budget is an easy way to begin the process. I assert that by 2023, one-third of FP&A organizations will have integrated HR planning with their budgeting process.

Increasing the business value of budgeting and planning for budget owners and executives should be a priority for FP&A organizations. Unfortunately, our research finds that two-thirds of companies use spreadsheets to manage their budgeting process. Desktop spreadsheets have inherent deficiencies that make them unsuitable for integrated business planning because they are silo-based and difficult to combine into a corporate-wide plan. Spreadsheets are two-dimensional grids that are functionally incapable of simultaneously handling things and money at an enterprise level. Dedicated planning and budgeting software is the right tool for the job. Dedicated software can also provide guidance during the planning and budgeting process as well as useful feedback as the planning period unfolds. It can do so using “things” (headcount, throughput, consumption) as well as money (budget accuracy, profitability) and KPIs (input-output ratios, not just money).

Increasing the business value of budgeting and planning for budget owners and executives should be a priority for FP&A organizations. Unfortunately, our research finds that two-thirds of companies use spreadsheets to manage their budgeting process. Desktop spreadsheets have inherent deficiencies that make them unsuitable for integrated business planning because they are silo-based and difficult to combine into a corporate-wide plan. Spreadsheets are two-dimensional grids that are functionally incapable of simultaneously handling things and money at an enterprise level. Dedicated planning and budgeting software is the right tool for the job. Dedicated software can also provide guidance during the planning and budgeting process as well as useful feedback as the planning period unfolds. It can do so using “things” (headcount, throughput, consumption) as well as money (budget accuracy, profitability) and KPIs (input-output ratios, not just money).

I recommend that FP&A units that have adopted zero-based budgeting or are planning to, reconsider this move within a broader context of evaluating the group’s mission. Integrated business planning can achieve the same objective as ZBB but deliver greater business value to the entire organization.

Regards,

Robert Kugel

By focusing planning and review discussions between executives and managers on the operational aspects of the plans, the process becomes more relevant to achieving business objectives and improving operational performance. Targets for Individual business units are set in both operational and financial terms: The focus is on business objectives while the financial consequences of the plan serve as a constraining objective and control mechanism rather than sole objective of the process.

By focusing planning and review discussions between executives and managers on the operational aspects of the plans, the process becomes more relevant to achieving business objectives and improving operational performance. Targets for Individual business units are set in both operational and financial terms: The focus is on business objectives while the financial consequences of the plan serve as a constraining objective and control mechanism rather than sole objective of the process. Increasing the business value of budgeting and planning for budget owners and executives should be a priority for FP&A organizations. Unfortunately, our

Increasing the business value of budgeting and planning for budget owners and executives should be a priority for FP&A organizations. Unfortunately, our