Close Automation is Essential for Digital Finance Transformation

As a rule, I dislike terms like “digital finance transformation” because there’s a wave-the -magic-wand quality to it that obscures the not-so-simple people and process elements necessary for true transformation. Six of the most common – and expensive – words used in an accounting department are “we’ve always done it this way.” Persuading staff to change can be a struggle, even if change makes their jobs easier and more rewarding. Moreover, digital transformation must cover the data elements as well as the process because manual data management is not only time-consuming at the data preparation stage, but it also creates the need for downstream reconciliations and other tasks to ensure accuracy.

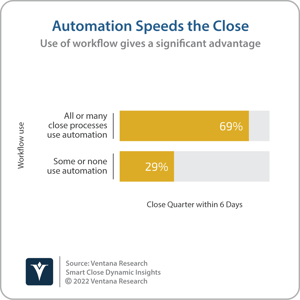

Software that automates the full scope of the accounting close, including reconciliations, consolidation and reporting, has grown more capable and affordable over the past five years. We added close, consolidate and report to our Office of Finance Market Agenda this year to highlight its growing importance. By enabling consistent process management that captures best practices and by automating rote, repetitive activities to boost staff productivity, these applications enable organizations to shorten the close, make the process more efficient and reduce the risk of material errors by strengthening accounting controls. As accounting departments have learned since 2020, close automation software helps ensure business continuity under any circumstance, especially as performing the close virtually via remote workforces becomes more commonplace. One important benefit of close automation is that it accelerates the process. Our Smart Close Dynamic Insights research found a correlation between the degree of automation and how soon an organization closes its books: 69% that have automated substantially all or many close processes are able to finish within six business days, compared to 29% that have automated some or none of the processes. Automation reduces staff hours required to complete the close and can eliminate the need for overtime and temporary staff hours. Having software-managed workflows enables accounting departments to standardize processes that conform to best practices. As our Fast Close Benchmark Research demonstrated, this control promotes efficiency: We found that 71% of organizations that were able to shorten the close did so by controlling the process effectively and consistently.

and report to our Office of Finance Market Agenda this year to highlight its growing importance. By enabling consistent process management that captures best practices and by automating rote, repetitive activities to boost staff productivity, these applications enable organizations to shorten the close, make the process more efficient and reduce the risk of material errors by strengthening accounting controls. As accounting departments have learned since 2020, close automation software helps ensure business continuity under any circumstance, especially as performing the close virtually via remote workforces becomes more commonplace. One important benefit of close automation is that it accelerates the process. Our Smart Close Dynamic Insights research found a correlation between the degree of automation and how soon an organization closes its books: 69% that have automated substantially all or many close processes are able to finish within six business days, compared to 29% that have automated some or none of the processes. Automation reduces staff hours required to complete the close and can eliminate the need for overtime and temporary staff hours. Having software-managed workflows enables accounting departments to standardize processes that conform to best practices. As our Fast Close Benchmark Research demonstrated, this control promotes efficiency: We found that 71% of organizations that were able to shorten the close did so by controlling the process effectively and consistently.

Manual systems built around electronic spreadsheets were once the common approach to handling the close, probably because this was very similar to paper-based methods. However, over the past decade, there  has been a decisive shift to substantially increase the use of automation and virtualize the close. Departments are coming to grips with the fact that desktop spreadsheets circulating as email attachments are too difficult to track and govern. They are becoming tired of endlessly tweaking an old consolidation system or using spreadsheets to paper over the inadequacies of the enterprise resource planning system’s consolidation process. Ventana Research asserts that by 2026, one-half of midsize and larger organizations will use close management software to speed the close and achieve greater control of the process.

has been a decisive shift to substantially increase the use of automation and virtualize the close. Departments are coming to grips with the fact that desktop spreadsheets circulating as email attachments are too difficult to track and govern. They are becoming tired of endlessly tweaking an old consolidation system or using spreadsheets to paper over the inadequacies of the enterprise resource planning system’s consolidation process. Ventana Research asserts that by 2026, one-half of midsize and larger organizations will use close management software to speed the close and achieve greater control of the process.

As finance and accounting departments digitize, they need affordable software to orchestrate and supervise how that work is performed. For the department to perform well, controllers and chief accounting officers need to avoid spending excessive time chasing details and instead focus their energy on consequential matters. They need software that ensures processes are started and completed on time, managing approvals and sign-offs. And they need software that requires their attention on details only when necessary.

Finance and accounting departments need workflow software to define, orchestrate and supervise the entire close process. This ensures that all the key tasks are completed, reviewed when necessary, and approved by all that must be involved. The process loses less time to poor coordination and dropped handoffs since the software automatically generates reminders that tasks must be started or are overdue. Controllers and chief financial officers can monitor progress and receive alerts and comments when snags appear, and the workflow manages approvals and sign-offs, recording when these take place and by whom. For many midsize organizations, this formal process and documentation will represent a higher level of control than currently in place.

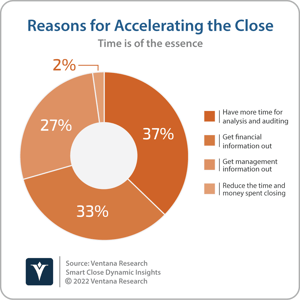

Investing in consolidated close and report automation software achieves important benefits that enhance the organization’s effectiveness by speeding the close and improving departmental efficiency. Just saving  time isn’t top of mind: Organizations say the most important reason for accelerating the close is to have more time for analysis (37%), get financial information out (33%) and get information to management (27%). Closing sooner and automating manual tasks also frees up staff time for more thorough analysis and reporting and promotes organizational agility, enabling decisions and actions to be made sooner.

time isn’t top of mind: Organizations say the most important reason for accelerating the close is to have more time for analysis (37%), get financial information out (33%) and get information to management (27%). Closing sooner and automating manual tasks also frees up staff time for more thorough analysis and reporting and promotes organizational agility, enabling decisions and actions to be made sooner.

Software also strengthens an organization’s accounting and financial statement integrity. Our research shows that 40% of organizations use desktop spreadsheets to manage the post-close and consolidation processes. This is problematic because manual processes supported by desktop spreadsheets are inefficient and pose serious control issues. Spreadsheets are error prone, and it’s not easy to verify their accuracy. Control is a key characteristic of a well-managed finance department, but when staff are overworked and stressed, the likelihood of lapses in control increase. As an organization expands, the growing number of accounts, entities and transactions — and the amplified organizational complexity — all increase the probability of errors and risk. For growing organizations, maintaining the integrity of accounting processes and systems grows more difficult as businesses become more complex. Automated workflows, approvals, controls and escalations address this challenge by promoting financial control and financial statement integrity. The system documents processes, and records that these processes were followed, reviewed and approved. The data collected by such systems also facilitates audits because all activity — especially exceptions — is easily discoverable.

Plus, attracting and retaining the most competent and motivated finance and accounting staff will become increasingly difficult without automation. This type of recruitment must be a priority for executives who want to build a winning team and a successful organization.

Along with using workflows to improve process execution, an organization’s first efforts — if not already underway — should include automating account and bank reconciliations. Manual reconciliation of these items is time-consuming, tedious and increasingly outmoded. This approach cuts the time spent by, for example, skipping accounts that haven’t changed or have zero balances. This allows accountants to pay closer attention to accounts where there are discrepancies. Bank reconciliations take data feeds from all bank accounts and, using rules, match these to entries from ERP systems. The software should include standard templates and manage reviews and approvals while incorporating supporting documentation. Here too, creating and retaining evidence that the work was completed, reviewed and approved — and that amounts tied —adds a necessary level of control for a midsize organization.

Although not every organization needs dedicated consolidation software, our research found that 40% of midsize and larger organizations mainly use spreadsheets for this task, including those with ERP systems from multiple vendors or multiple instances from a single vendor — usually because of different charts of account — or those with complex legal entity structures. Those organizations should consider the benefits of using a dedicated application. Organizations that use an ERP system’s consolidation functionality (31% of midsize organizations and 21% of larger entities) should assess whether dedicated software can do the job faster and with greater control.

I recommend that chief financial officers and controllers assess their current close and post-close processes to determine how automation can improve their department’s performance. Organizations that take more than a business week to close the books should examine how software can speed the process. Finance and accounting departments that spend time fighting fires rarely live up to their potential and usually do not support their organization as effectively as they could. Departments that rely on manual or desktop spreadsheet-based processes can easily fall behind in their daily work because they do not operate in the most efficient way possible. Growing midsize organizations can find that the increasing complexity of operations — and how to account for them — can manifest in problems that were previously masked.

Justifying the investment can be very straightforward: Automation can cut workloads immediately and into the future, thus creating ongoing savings. Close management software can enhance controls, ensure compliance and reduce the time and money spent on audits. And software that shortens the close can enhance a growing organization’s agility by providing executives and managers with information sooner. CFOs and controllers of organizations of any size should investigate the value that software can bring to the close month after month and quarter after quarter.

Regards,

Robert Kugel

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for ISG Software Research. His team covers technology and applications spanning front- and back-office enterprise functions, and he runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).