Ventana Research recently published benchmark research findings on the Office of Finance, many of which show a trend in the right direction. Organizations are closing the books sooner; financial planning and analysis has improved; and companies are more frequently establishing Finance IT groups to manage the increasingly technological requirements for effectiveness.

However, one participant category isn’t demonstrating the same gains: midsize organizations. We define a midsize organization as one with between 100 and 999 employees. This group typically faces the challenge of having to deal with a higher degree of organizational and operational complexity than small organizations do. Even at the lower end of the range, the nature of the business may involve managing convoluted processes or require handling and reporting large amounts of operational data for regulatory purposes. In addition, these organizations may be made up of a large number of legal entities because they are geographically dispersed or because they need to limit legal liability.

Unfortunately, although midsize companies face many of the same challenges as larger ones, typically they lack the resources that larger companies can bring to bear in dealing with complexity. One example of more limited resources is the lack of a dedicated Finance IT (FIT) group. Two-thirds (68%) of companies with 1,000 or more employees have such a group in  their finance department compared to half (49%) of midsize companies and one-fourth (25%) of small businesses. Our recent Office of Finance Benchmark Research found a correlation between having a FIT group and achieving superior performance.

their finance department compared to half (49%) of midsize companies and one-fourth (25%) of small businesses. Our recent Office of Finance Benchmark Research found a correlation between having a FIT group and achieving superior performance.

This lack of resources is reflected in performance measures. While nearly half (45%) of larger companies perform financial analysis very well, only 29 percent of midsize companies achieve that level. This gap is also apparent in budgeting and fiscal control (40% versus 27%) and strategic and long-range planning (38% versus 28%).

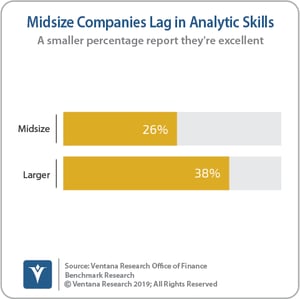

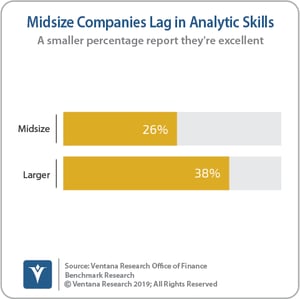

There’s also the possibility of another skills gap at work. While 26 percent of midsize companies said they believe that the analytical skills of the people in their finance department are excellent, 38 percent of those in larger companies think that’s the case. It may be that larger companies find it easier to attract people with excellent analytical skills because they offer better career opportunities or higher compensation, have more scope for specialization in their workforce or some combination of all three.

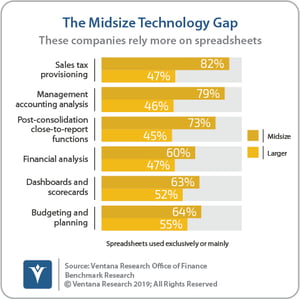

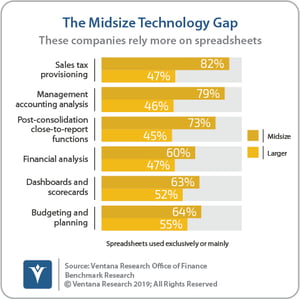

There’s also a technology gap between midsize and larger organizations, specifically in the more constant use of spreadsheets by midsize companies to manage core processes. The gap is greatest in areas such as sales tax provision  (82% versus 47%), management accounting (79% of midsize companies use spreadsheets compared to 46% of larger ones) and post-consolidation close-to-report functions (73% versus 45%). The gap is least pronounced in areas such as budgeting and planning (64% versus 55%), dashboards and scorecards (63% versus 52%) and financial analysis (60% versus 47%). A likely cause for these discrepancies is a rough cost-benefit difference that exists between midsize and larger companies — that is, the cost of the software to replace desktop spreadsheets is greater than benefits of time savings, greater accuracy and increased transparency, to name three. In addition to having to deal with bigger data sets, larger organizations have more complex organizational and legal structures that make spreadsheets unwieldy for management accounting and tax provision.

(82% versus 47%), management accounting (79% of midsize companies use spreadsheets compared to 46% of larger ones) and post-consolidation close-to-report functions (73% versus 45%). The gap is least pronounced in areas such as budgeting and planning (64% versus 55%), dashboards and scorecards (63% versus 52%) and financial analysis (60% versus 47%). A likely cause for these discrepancies is a rough cost-benefit difference that exists between midsize and larger companies — that is, the cost of the software to replace desktop spreadsheets is greater than benefits of time savings, greater accuracy and increased transparency, to name three. In addition to having to deal with bigger data sets, larger organizations have more complex organizational and legal structures that make spreadsheets unwieldy for management accounting and tax provision.

CFOs in midsize companies must recognize the importance of using technology to enhance the performance of their finance and accounting organization. Technology has evolved over the past decade in ways that especially benefit midsize companies and the Office of Finance. Technology has the potential to close the skills and cost-benefit gaps between midsize and larger organizations. It levels the skills playing field because applications increasingly are able, for example, to enhance the analytics capabilities of an organization. And software as a service shifts application management to a third-party provider that’s likely to have greater expertise in managing the software, ensuring it is fully up to date and that it’s running on the most up-to-date hardware.

Meanwhile, the cost-benefit gap has narrowed; the total cost of ownership of a SaaS offering is usually competitive with the on-premises option. Because cloud-based computing resources can be scaled up and down, midsize companies can access considerably more power than they could afford on their own.

Midsize company CFOs must ensure that they have the internal skills to manage technology effectively. Even a Finance IT team of one-half (that is, a person with FIT skills who has other duties) would be helpful and likely affordable.

Regards

Robert Kugel

their finance department compared to half (49%) of midsize companies and one-fourth (25%) of small businesses. Our recent Office of Finance Benchmark Research found a correlation between

their finance department compared to half (49%) of midsize companies and one-fourth (25%) of small businesses. Our recent Office of Finance Benchmark Research found a correlation between  (82% versus 47%), management accounting (79% of midsize companies use spreadsheets compared to 46% of larger ones) and post-consolidation close-to-report functions (73% versus 45%). The gap is least pronounced in areas such as budgeting and planning (64% versus 55%), dashboards and scorecards (63% versus 52%) and financial analysis (60% versus 47%). A likely cause for these discrepancies is a rough cost-benefit difference that exists between midsize and larger companies — that is, the cost of the software to replace desktop spreadsheets is greater than benefits of time savings, greater accuracy and increased transparency, to name three. In addition to having to deal with bigger data sets, larger organizations have more complex organizational and legal structures that make spreadsheets unwieldy for management accounting and tax provision.

(82% versus 47%), management accounting (79% of midsize companies use spreadsheets compared to 46% of larger ones) and post-consolidation close-to-report functions (73% versus 45%). The gap is least pronounced in areas such as budgeting and planning (64% versus 55%), dashboards and scorecards (63% versus 52%) and financial analysis (60% versus 47%). A likely cause for these discrepancies is a rough cost-benefit difference that exists between midsize and larger companies — that is, the cost of the software to replace desktop spreadsheets is greater than benefits of time savings, greater accuracy and increased transparency, to name three. In addition to having to deal with bigger data sets, larger organizations have more complex organizational and legal structures that make spreadsheets unwieldy for management accounting and tax provision.