The challenges of the pandemic prevented auditors from visiting client offices, which led to widespread adoption of remote audit processes. Although there are outward similarities between a remote audit and a virtual audit, they aren’t the same. A remote audit uses technology to adapt the existing audit processes to an environment where in-person interactions are impossible. A virtual audit uses technology to redefine and streamline how auditors conduct an annual audit.

A virtual audit reduces process frictions and eliminates unnecessary work for both the auditor and client, while substantially reducing the time auditors need to spend on-site. It does so by providing the auditor’s staff direct but controlled access to an organization’s finance and accounting systems.

I expect relatively rapid adoption of the virtual audit and assert that by 2025, more than one-half of organizations will have adopted some form of a virtual audit, saving staff time and cutting departmental costs.

I expect relatively rapid adoption of the virtual audit and assert that by 2025, more than one-half of organizations will have adopted some form of a virtual audit, saving staff time and cutting departmental costs.

Reducing audit costs ought to be a priority for the CFO. While cutting audit fees depends a great deal on a company’s circumstances and can be problematic, almost all companies can realize a significant reduction in staff time devoted to the annual audit and its related expenses. Because of its impact on the organization, improving the efficiency of the external audit should be top-of-mind for the CFO and controller.

Technology can cut audit-related workloads and the disruptions caused by auditors that reduce internal staff productivity. It also can cut the time needed by the auditor to complete the process and enable an organization to reduce fees to best-in-class levels.

As many departments discovered in 2020, technology is a critical element to promote resiliency and sustainability in the finance and accounting function. Using the right technology, organizations were able to easily close the books virtually, quickly reforecast cash flows under different scenarios and perform the full range of core departmental functions even when staff weren’t able to be together in the office. Technology also enables a higher quality, more cost-effective audit by reducing staff time currently devoted to this process.

The objective of the virtual audit is to make the process as self-service as possible for the auditor. The key is having the appropriate technology in place. Creating a virtual audit doesn’t have to be all-encompassing at the start but can be implemented in stages.

A finance department can get an idea of the systems and data sources auditors will need to access directly by reviewing prior annual audit activities and examining the provided-by-client (PBC) information request. In most cases, the best place to start virtualizing the audit is the ERP system or systems, providing the auditor with read-only access to the organization’s financial information. The system’s security can be used to ensure that only those with the right permissions gain access during the limited period the organization defines, and block access to non-essential and confidential information.

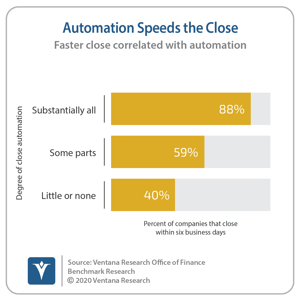

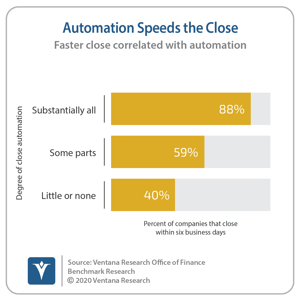

Another application that’s useful for virtual audits is a close management system. Software that manages the accounting close has become popular because it provides multiple benefits. Our recent Benchmark Research on the Office of Finance confirms the value of using a close management system: 88% of organizations with a high degree of automation close within six business days compared to 59% that have some automation and 40% that apply little or no automation. Beyond efficiency benefits, closing sooner enables the department to provide financial and management data to the rest of the organization sooner. The research finds that a solid majority (62%) of companies that close within six business days provide timely information compared to 39% that take longer.

Another application that’s useful for virtual audits is a close management system. Software that manages the accounting close has become popular because it provides multiple benefits. Our recent Benchmark Research on the Office of Finance confirms the value of using a close management system: 88% of organizations with a high degree of automation close within six business days compared to 59% that have some automation and 40% that apply little or no automation. Beyond efficiency benefits, closing sooner enables the department to provide financial and management data to the rest of the organization sooner. The research finds that a solid majority (62%) of companies that close within six business days provide timely information compared to 39% that take longer.

For audits, close management software electronically manages the paper trail related to the close, including file attachments, review notes, sign-offs and comments. The software minimizes the amount of physical paper required for the close procedures. Using technology to replace paper means that every month and every quarter, all documents related to the close are organized and stored electronically. The software provides evidence of managing the close in a way that assures strong accounting controls. Close automation systems provide a comprehensive electronic file box which streamlines audits and reviews. That’s because the virtual file box can be examined at any time by anyone with the appropriate permissions.

Other software useful in a virtual audit includes the financial consolidation system, which provides evidence that the process was executed properly and a means of detecting and investigating suspicious activities. Reconciliations software also provides evidence of how that aspect of accounting was performed. An organization’s risk management software can document that necessary internal audit analysis was completed by the system to mitigate fraud or identify where there are separation of duties issues or access violations. The auditor can access the risk and controls matrix documentation directly and confirm that changes to processes and controls called out in the previous audit have been made. This demonstrates that systems are in place to monitor security and manage access workflows. Demonstrating control of information systems is an essential part of ensuring the quality and soundness of a company’s financials.

A virtual audit is also feasible for most organizations because of the changes made to deal with the lockdowns that have shut offices. A document-sharing system, for example, enables remote viewing, commenting and editing of documents needed by the auditor. Many companies also have a secure collaborative environment that supports messaging and video chat to facilitate one-on-one or small group conversations in an anytime, anyplace fashion.

I recommend that CFOs and controllers evaluate moving to a virtual audit in consultation with auditors. The virtual audit is an attractive option for both parties because it makes it possible to cut everyone’s workload. While on-site visits are likely to resume, a virtual audit can condense it to days from one or two weeks, saving the organization money and reducing the hassle of travel and living in a hotel for days on end.

Regards,

Robert Kugel

I expect relatively rapid adoption of the virtual audit and assert that by 2025, more than one-half of organizations will have adopted some form of a virtual audit, saving

I expect relatively rapid adoption of the virtual audit and assert that by 2025, more than one-half of organizations will have adopted some form of a virtual audit, saving  Another application that’s useful for virtual audits is a close management system. Software that manages the accounting close has become popular because it provides

Another application that’s useful for virtual audits is a close management system. Software that manages the accounting close has become popular because it provides