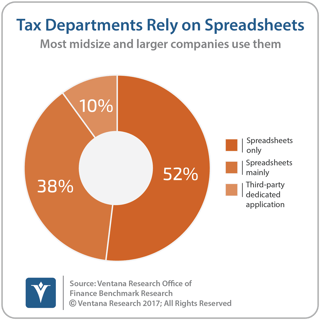

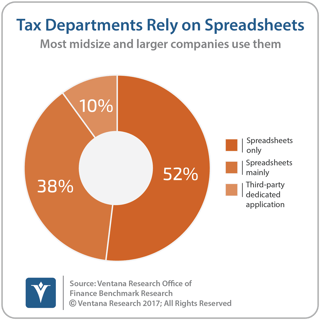

I’ve long advocated the use of effective technology in the tax function, especially for organizations that operate in multiple jurisdictions or have complex legal structures manage direct tax provision and analysis using outdated or inappropriate tools. Our Office of Finance benchmark research reveals that most organizations use spreadsheets to manage their tax  provision and analysis: Half (52%) rely solely on spreadsheets, and another 38 percent mainly use them. I recommend to corporations that operate in multiple countries and that have even a moderately complex legal entity structure that they consider establishing what I call a tax data warehouse of record.

provision and analysis: Half (52%) rely solely on spreadsheets, and another 38 percent mainly use them. I recommend to corporations that operate in multiple countries and that have even a moderately complex legal entity structure that they consider establishing what I call a tax data warehouse of record.

A tax data warehouse of record is a recasting of all of a corporation’s tax-relevant financial data in a tax-centric way. This is necessary because tax accounting exists in a parallel universe to financial and management accounting. Such a warehouse can deal not just with the routine differences in accounting treatments such as tax depreciation vs. book depreciation. Governments impose taxes on legal entities, and in some cases a corporation may be made up of multiple types of legal entities with different corporate structures that fall under different tax regimes in a tax jurisdiction. What’s more, organizations evolve with acquisitions, divestitures and restructurings, which over time usually cause changes in their accounting structures. However, tax authorities care nothing about this – they care only about the tax accounting for each legal entity in the tax year in question under the laws then applicable. Tax accounting isn’t continuous – it is structured by separate time frames. There may carry over from one period to the next, but changes in corporate structure or statutes may require adjustments from one period to the next. Keeping track of these myriad details is straightforward in a tax database of record, but it is highly time-consuming and error-prone when done using desktop spreadsheets.

Vertex Enterprise is a tax management and analysis platform that supports the full cycle of tax processes, including planning, provision and accounting, compliance and audit. It transforms financial system data into tax-ready formats, consolidated by currency and accounting standard, and incorporates all necessary global tax content. It handles both direct (income) tax and indirect or transaction tax (such as sales tax and VAT) categories. Vertex has pre-built integration into financial systems and recent support announced for SAP BusinessObjects and Oracle ERP Cloud.

Vertex Enterprise translates a company’s results into a jurisdictional context rather than a corporate one and then maintains the translated data in a perfect “as was” state. The translation is necessary because in many companies for which a legal entity structure in the chart of accounts isn’t mandated by law, there may not be a one-to-one relationship between legal entities and the accounting structure. Routinely, there are differences between tax and generally accepted accounting principles in the treatment of certain transactions. Often, when companies reorganize, accounting data for past periods may be altered to reflect the changes, a move that makes it more difficult for tax departments to reconstruct history as it needs to be presented in a tax audit defense, for example. In such situations, it’s valuable to have a dedicated tax database that preserves data, formulas and calculations that went into the tax provision. The database also can be used to preserve tax records for the statutorily defined period and, equally important, to eliminate these records when the retention period expires. In addition, the tax-relevant characteristics of the legal entities (such as their domicile and places of nexus) can change over time.

Also, from a tax standpoint, “time” may have a different meaning than it does in the general accounting context. For instance, if a grace period applies to the tax accounting, an event that takes place in fiscal year 2017 may be a 2016 event from a tax standpoint. Some countries (such as Japan and Sweden) have mandated year-ends that are not calendar year-ends and may not match a company’s fiscal year. Maintaining all of this in an as-was state is critical for tax purposes because that is the only valid reference framework when dealing with taxing authorities.

Vertex Enterprise can substantially reduce the amount of time it takes to prepare taxes and deal with audits because it saves all the data, formulas, calculations and notes as they existed in the provision process. Standard reports can be produced instantly with reliable data. The visibility that Vertex Enterprise provides for companies is growing in importance. Those that have legal entities in multiple countries face increasing scrutiny of their tax positions and can benefit from using dedicated tax software to manage their taxes more intelligently. Companies can use Vertex Enterprise as a collaborative tool in which analyses and models can be stored, accessed and reused. They’re also likely to find that it gives them improved control and auditability, since access can be limited to a small group of tax professionals and corporations can maintain a separate audit trail for tax-related items.

Vertex Enterprise also can be used for multiyear contingency tax planning at a reasonable level of granularity. This has been difficult for larger companies to do using spreadsheets because of the complexity of working with the multiple dimensions of legal entities, jurisdictions, time, currency and accounting standards. Year-to-year adjustments and true-ups that might be the result of some scenario are also difficult to manage in spreadsheet models. Moreover, many companies consolidate spreadsheets manually, which is also time-consuming as well as error-prone. Contingent tax planning can be useful in determining strategies for legal restructurings, the timing of events with significant tax consequences (such as acquisitions, investments or divestitures) and for assessing the impact of proposed changes to tax rates or other legislated actions that affect a company’s tax liabilities.

I recommend that any company that operates in multiple countries with even a modestly complex legal structure assess whether Vertex Enterprise would benefit its tax operations and ultimately its bottom line.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter @rdkugelVR

and connect with me on LinkedIn.