We recently issued our 2013 Value Index on Financial Performance Management. Ventana Research defines financial performance management (FPM) as the process of addressing the often overlapping people, process, information and technology issues that affect how well finance organizations operate and support the activities of the rest of their organization. FPM deals with the full cycle of finance department activities, which includes planning and budgeting, analysis, assessment and review, closing...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

closing,

Consolidation,

contingency planning,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Value Index,

Financial Performance Management

I recently attended Vision 2013, IBM’s annual conference for users of its financial governance, risk management and sales performance management software. These three groups have little in common operationally, but they share software infrastructure needs and basic supporting software components such as reporting and analytics. Moreover, while some other major vendors’ user group meetings concentrate on IT departments, Vision focuses on business users and their needs, which is a welcome...

Read More

Topics:

Planning,

Reporting,

Budgeting,

closing,

XBRL,

Analytics,

Data Management,

IBM,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

SEC,

TM1,

Digital Technology

At this year’s Inforum user group conference, Infor representatives showed the progress the organization has made since last year in transforming itself from a ragbag of mostly small, often obsolete software companies to a competitive vendor of a modern enterprise management software suite. Infor was created by private equity investors employing a “rollup” strategy, aimed at combining smaller companies within an industry to form a single larger company that could achieve economies of scale and...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

GRC,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

closing,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Infor,

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM,

SEC

The International Integrated Reporting Council (IIRC) recently published a draft framework outlining how it believes businesses ought to communicate with their stakeholders. In this context the purpose of an “integrated report” is to promote corporate transparency by clearly and concisely presenting how an organization’s strategy, governance, and financial and operational performance will create value for shareholders and other stakeholders in both the short and the long term. Such a report...

Read More

Topics:

Sustainability,

Office of Finance,

closing,

XBRL,

Business Analytics,

Business Intelligence,

Information Applications (IA),

Information Management (IM),

financial reporting,

FPM,

SASB,

SEC

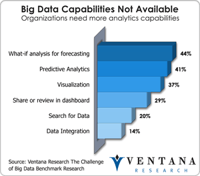

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

costing,

FPM,

Profitability

IBM this week announced its pending acquisition of the Star Analytics product portfolio. Star Analytics is a privately held company that offers products designed to provide easy access to and integration with Oracle Hyperion data sources. While Star Analytics has a good product and solid references, it has lacked critical mass to support more effective sales and marketing efforts. Star Analytics’ strategic value to IBM lies in its ability to unlock data held in Oracle Essbase multidimensional...

Read More

Topics:

Reporting,

closing,

Essbase,

Hyperion,

Analytics,

Business Analytics,

Business Collaboration,

Data Integration,

IBM,

Oracle,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management,

Star Analytics,

TM1

As I’ve noted before, it’s common for CFOs of companies that are transitioning from being a small to a midsize business (that is, when they grow past about 100 employees) to find that the entry-level accounting package that they have been using no longer fits their needs. This software may be inexpensive to purchase and easy to use but it lacks many of the customization and business process management capabilities that become increasingly important as organizations grow. The transition from...

Read More

Topics:

Planning,

Salesforce.com,

ERP,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Cloud Computing,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Workforce Performance Management (WPM),

Financial Performance Management,

FinancialForce.com

This is the third in a series of blog posts on what CEOs (and for that matter, all senior corporate executives) need to know about IT and its impact on running a business. The first covered the high-level issues. As I noted, it’s not necessary for a CEO to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, CEOs must grasp the basics of IT just as they must understand basic corporate finance, the production process and – at least at a high...

Read More

Topics:

Planning,

Predictive Analytics,

Sales,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

PRO,

Analytics,

Business Analytics,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Management (IM),

Sales Performance Management (SPM),

CEO,

FPM,

Profitability,

SPM

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

For several years the U.S. Securities and Exchange Commission (SEC) has mandated that filers apply eXtensible Business Reporting Language (XBRL) tags to their financial statements. XBRL was developed to make it easier for investors to use a company’s financial information. Now XBRL US has kicked off its second annual XBRL Challenge, a contest designed to encourage development of open source analytical tools that can use XBRL-formatted corporate financial data from the SEC’s EDGAR database....

Read More

Topics:

Office of Finance,

Reporting,

closing,

XBRL,

Analytics,

Business Analytics,

Business Performance Management (BPM),

finance,

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management,

SEC