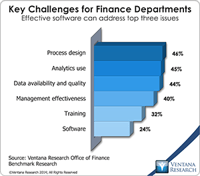

Our recently published Office of Finance benchmark research assesses a broad set of functions and capabilities of finance organizations. We asked research participants to identify the most important issues for a finance department to address in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management,...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

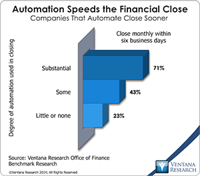

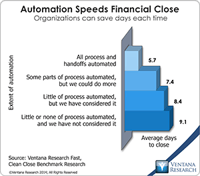

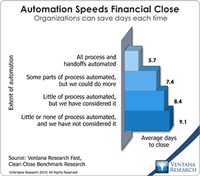

Our recent Office of Finance benchmark research demonstrates the importance of using automation to execute finance department functions. Information technology systems do at least two things very well that make better use of people’s time, and both of them can substantially improve organizational performance. First, they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires judgment and skill. IT systems also can be programmed...

Read More

Topics:

Big Data,

Mobile,

Planning,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

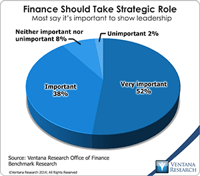

Finance transformation” refers to a longstanding objective: shifting the focus of CFOs and finance departments from transaction processing to more strategic, higher-value functions. Our upcoming Office of Finance benchmark research confirms that most of organizations want their finance department to take a more strategic role in management of the company: nine in 10 participants said that it’s important or very important. (We are using “finance” in its broadest sense, including, for example,...

Read More

Topics:

Big Data,

Mobile,

Performance Management,

Predictive Analytics,

Social Media,

ERP,

FP&A,

Office of Finance,

Reporting,

Management,

close,

closing,

computing,

Controller,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

finance,

Financial Performance Management (FPM),

Tagetik,

FPM

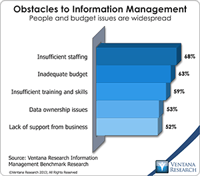

When applying information technology to drive better business performance, companies and the systems integrators that assist them often underestimate the importance of organizing data management around processes. For example, companies that do not execute their quote-to-cash cycle as an end-to-end process often experience a related set of issues in their sales, marketing, operations, accounting and finance functions that stem from entering the same data into multiple systems. The inability to...

Read More

Topics:

Big Data,

Mobile,

ERP,

Office of Finance,

Operational Performance Management (OPM),

Operations,

Management,

close,

closing,

computing,

end-to-end,

Analytics,

Cloud Computing,

Data Management,

Business Performance Management (BPM),

CRM,

Data,

finance,

Information Applications (IA),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

FPM

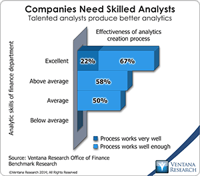

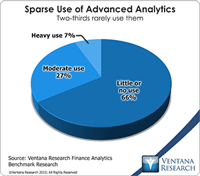

Finance and accounting departments are staffed with numbers-oriented, naturally analytical people. Strong analytic skills are essential if a finance department is to deliver deep insights into performance and visibility into emerging opportunities and challenges. The conclusions of analyses enable fast, fully informed business decisions by executives and managers. Conversely, flawed analyses undermine the performance of a company. So it was good news that in our Office of Finance benchmark...

Read More

Topics:

Big Data,

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Tagetik,

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

“What’s next?” is the perennially insistent question in information technology. One common observation about the industry holds that cycles of innovation alternate between hardware and software. New types and forms of hardware enable innovations in software that utilize the power of that hardware. These innovations create new markets, alter consumer behavior and change how work is performed. This, in turn, sets the stage for new types and forms of hardware that complement these emerging product...

Read More

Topics:

Mobile,

Performance Management,

Predictive Analytics,

ERP,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Wearable Computing,

Management,

close,

closing,

computing,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

Host Analytics has introduced AirliftXL, a new feature of its cloud-based financial performance management (FPM) suite that enables its software to translate users’ spreadsheets into the Host Analytics format. I find it significant in three respects. First, it can substantially reduce the time and resources it takes for a company to go live in adopting the Host Analytics suite, lowering the cost of implementation and accelerating time to value. Second, it enables Host Analytics users who have...

Read More

Topics:

Modeling,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

closing,

Consolidation,

Controller,

Host Analytics,

Analytics,

Business Analytics,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Workforce Performance Management (WPM),

Financial Performance Management,

FPM

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

In-memory,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software