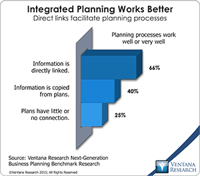

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Predictive Analytics,

Customer Experience,

Marketing Planning,

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning

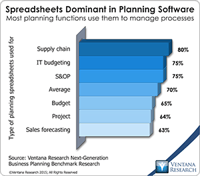

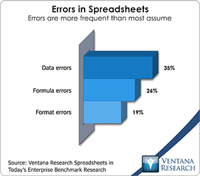

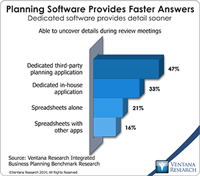

Our benchmark research on next-generation business planning finds that a large majority of companies rely on spreadsheets to manage planning processes. For example, four out of five use them for supply chain planning, and about two-thirds for budgeting and sales forecasting. Spreadsheets are the default choice for modeling and planning because they are flexible. They adapt to the needs of different parts of any type of business. Unfortunately, they have inherent defects that make them...

Read More

Topics:

Planning,

Marketing Planning,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Demand Planning,

Integrated Business Planning

IBM’s Vision user conference brings together customers who use its software for financial and sales performance management (FPM and SPM, respectively) as well as governance, risk management and compliance (GRC). Analytics is a technology that can enhance each of these activities. The recent conference and many of its sessions highlighted IBM’s growing emphasis on making more sophisticated analytics easier to use by – and therefore more useful to – general business users and their organizations....

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Operational Performance Management (OPM),

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

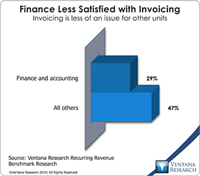

Revenue recognition standards for companies that use contracts are in the process of changing, as I covered in an earlier perspective. As part of managing their transition to these standards, CFOs and controllers should initiate a full-scale review of their order-to-cash cycle. This should include examination of their company’s sales contracts and their contracting process. They also should examine how well their contracting processes are integrated with invoicing and billing and any other...

Read More

Topics:

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Revenue Performance,

Budgeting,

Tax,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world)....

Read More

Topics:

Planning,

Customer Experience,

Office of Finance,

Reporting,

Revenue Performance,

Budgeting,

Tax,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

commission,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

Adaptive Insights held its annual user group meeting recently. A theme sounded in several keynote sessions was the importance of finance departments playing a more strategic role in their companies. Some participating customers described how they have evolved their planning process from being designed mainly to meet the needs of the finance department into a useful tool for managing the entire business. Their path took them from doing basic financial budgeting to planning focused on improving...

Read More

Topics:

Planning,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning

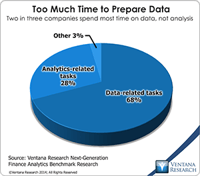

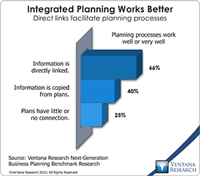

Ventana Research recently released the results of our Next-Generation Business Planning benchmark research. Business planning encompasses all of the forward-looking activities in which companies routinely engage. The research examined 11 of the most common types of enterprise planning: capital, demand, marketing, project, sales and operations, strategic, supply chain and workforce planning, as well as sales forecasting and corporate and IT budgeting. We also aggregated the results to draw...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Sales,

Social Media,

Human Capital Management,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Business Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Workforce Performance Management (WPM),

capital spending,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning,

S&OP

Business planning includes all of the forward-looking activities in which companies routinely engage. Companies do a great deal of planning. They plan sales and determine what and how they will produce products or deliver services. They plan the head count they’ll need and how to organize distribution and their supply chain. They also produce a budget, which is a financial plan. The purpose of planning is to be successful. Planning is defined as the process of creating a detailed formulation of...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Human Capital,

Sales and Forecasting,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

Demand Planning,

Integrated Business Planning,

Project Planning,

S&OP

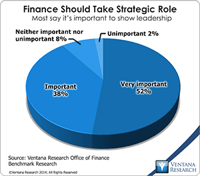

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

CIO,

In-memory,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

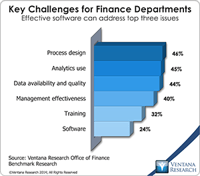

Our recently published Office of Finance benchmark research assesses a broad set of functions and capabilities of finance organizations. We asked research participants to identify the most important issues for a finance department to address in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management,...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets